How to buy Bancor Network Token (BNT)

Discover where and how to buy Bancor Network Token online. With Kriptomat, buying BNT and other cryptocurrencies is easy, quick, and secure.

Trusted by 400,000+ users across Europe

Buying Bancor Network Token with Kriptomat

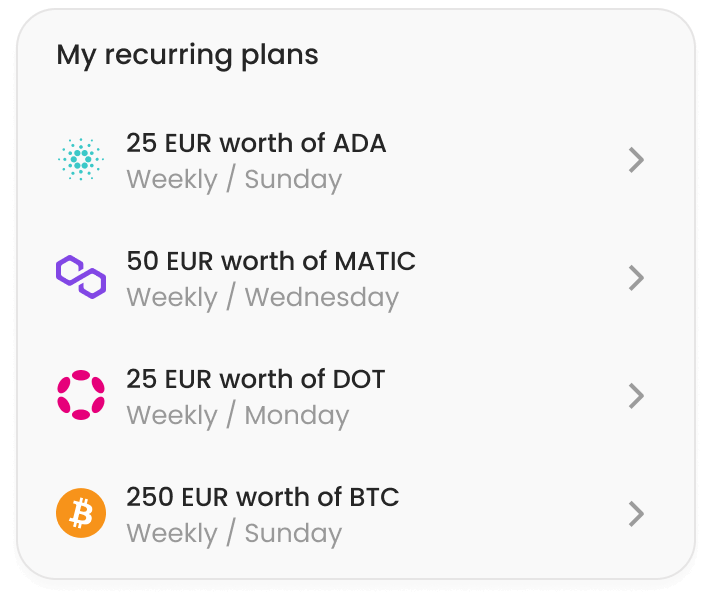

Three simple steps to purchase Bancor Network Token with Kriptomat:

Create and verify your account

Sign up with Google, Apple or enter your name and email. Verify your email, phone number and identity. Congratulations, you have unlocked the full potential of the Kriptomat platform within minutes!

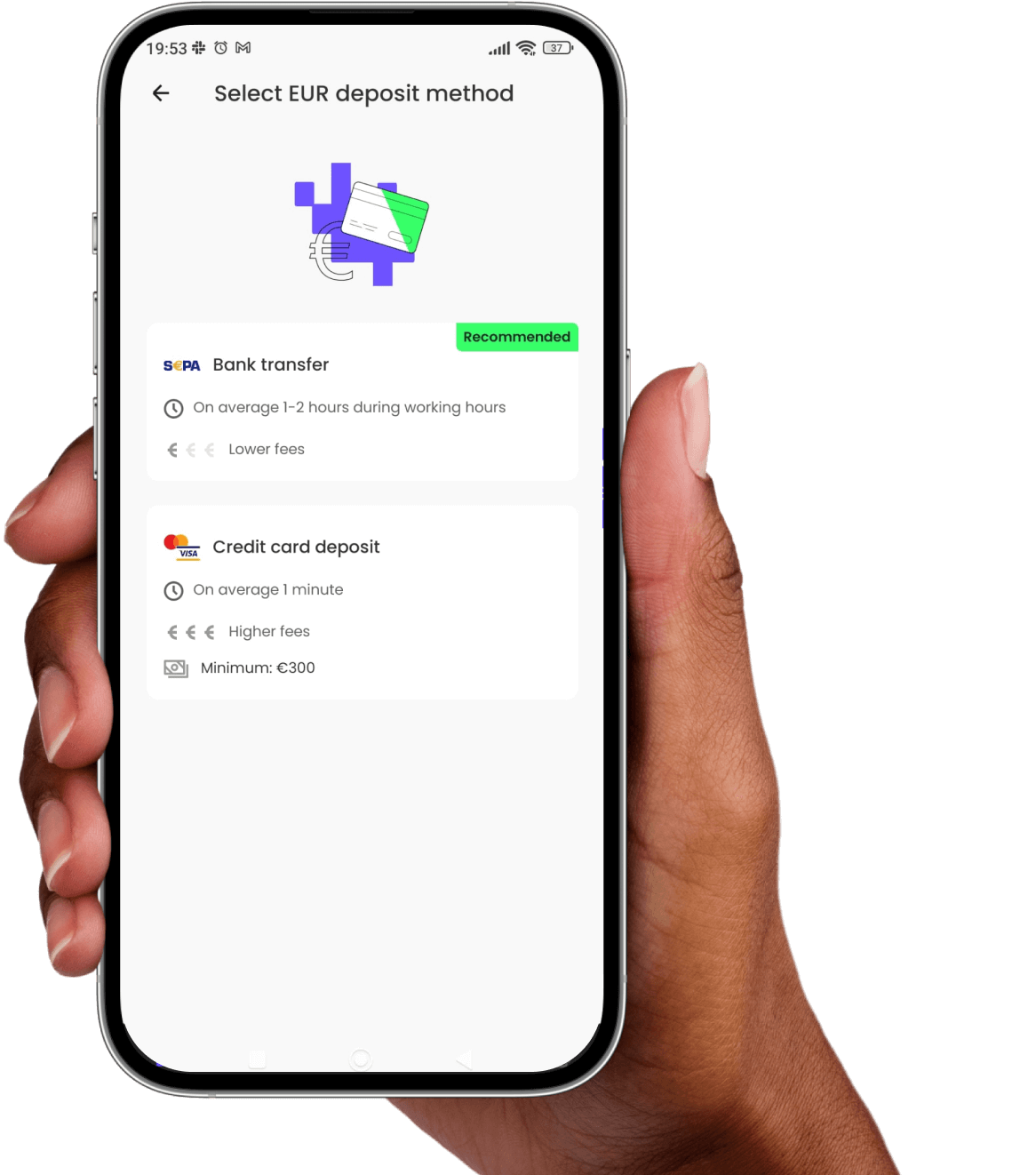

Add funds

Make a bank deposit or use your credit card to add funds even faster. Now, you are ready to buy BNT and 280+ other cryptocurrencies.

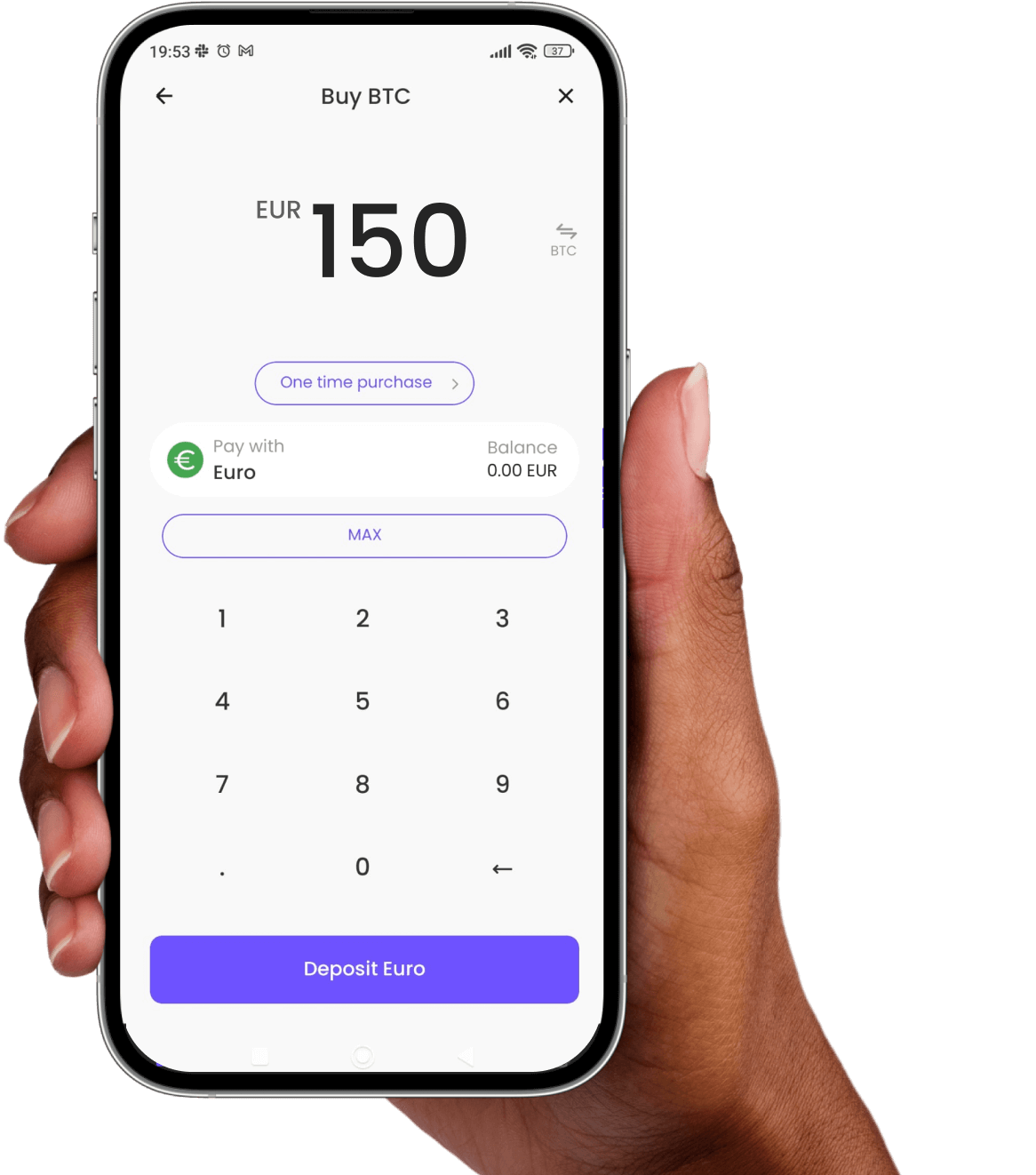

Buy Bancor Network Token

Click on the Kriptomat icon and select “Buy”. Choose Bancor Network Token from the list of cryptocurrencies. Enter the amount, preview transaction and confirm your purchase. You now own Bancor Network Token!

IOS

IOS Android

Android