How to buy Litecoin (LTC)

Discover where and how to buy Litecoin online. With Kriptomat, buying LTC and other cryptocurrencies is easy, quick, and secure.

Trusted by 400,000+ users across Europe

Buying Litecoin with Kriptomat

Three simple steps to purchase Litecoin with Kriptomat:

Create and verify your account

Sign up with Google, Apple or enter your name and email. Verify your email, phone number and identity. Congratulations, you have unlocked the full potential of the Kriptomat platform within minutes!

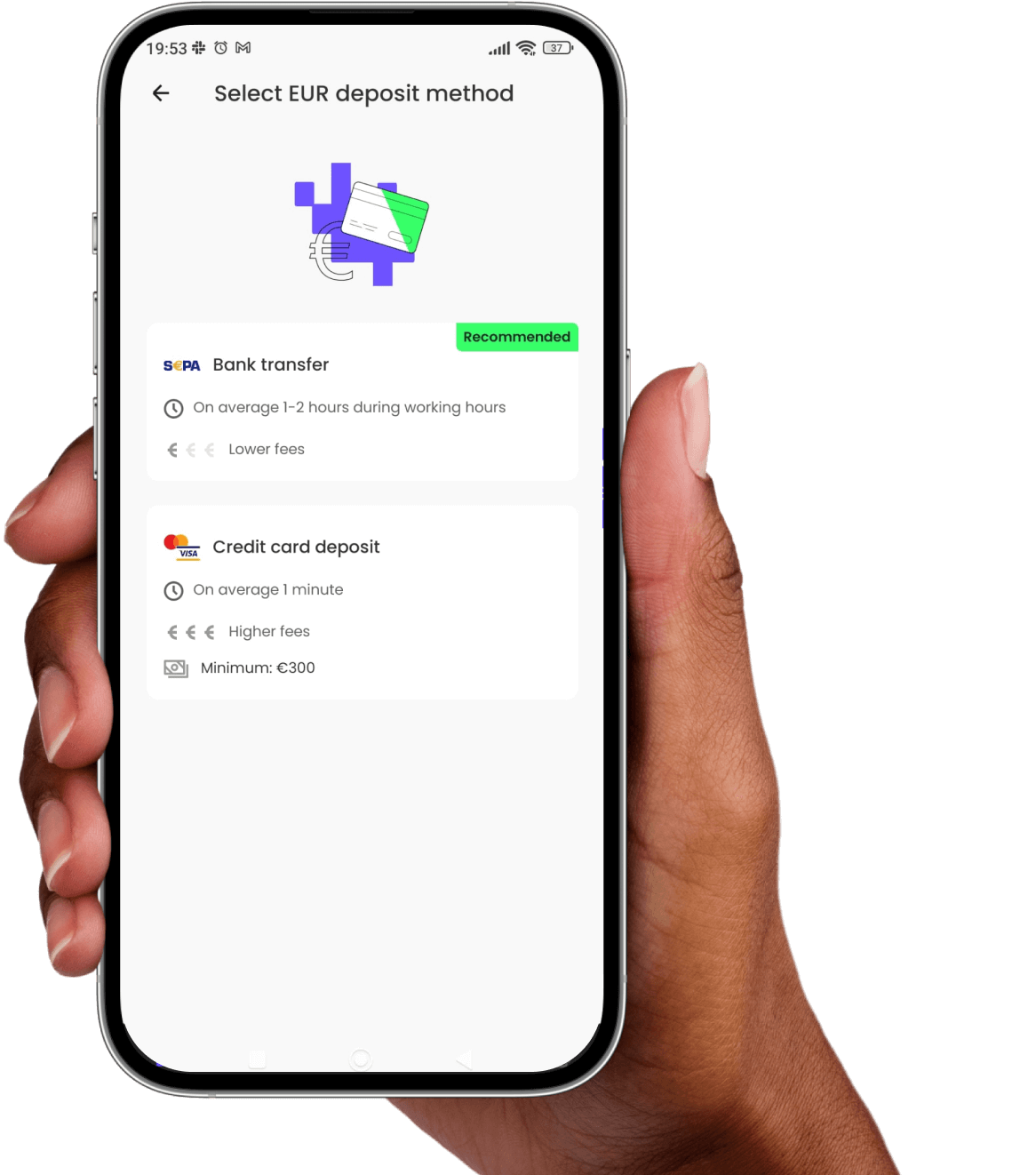

Add funds

Make a bank deposit or use your credit card to add funds even faster. Now, you are ready to buy LTC and 280+ other cryptocurrencies.

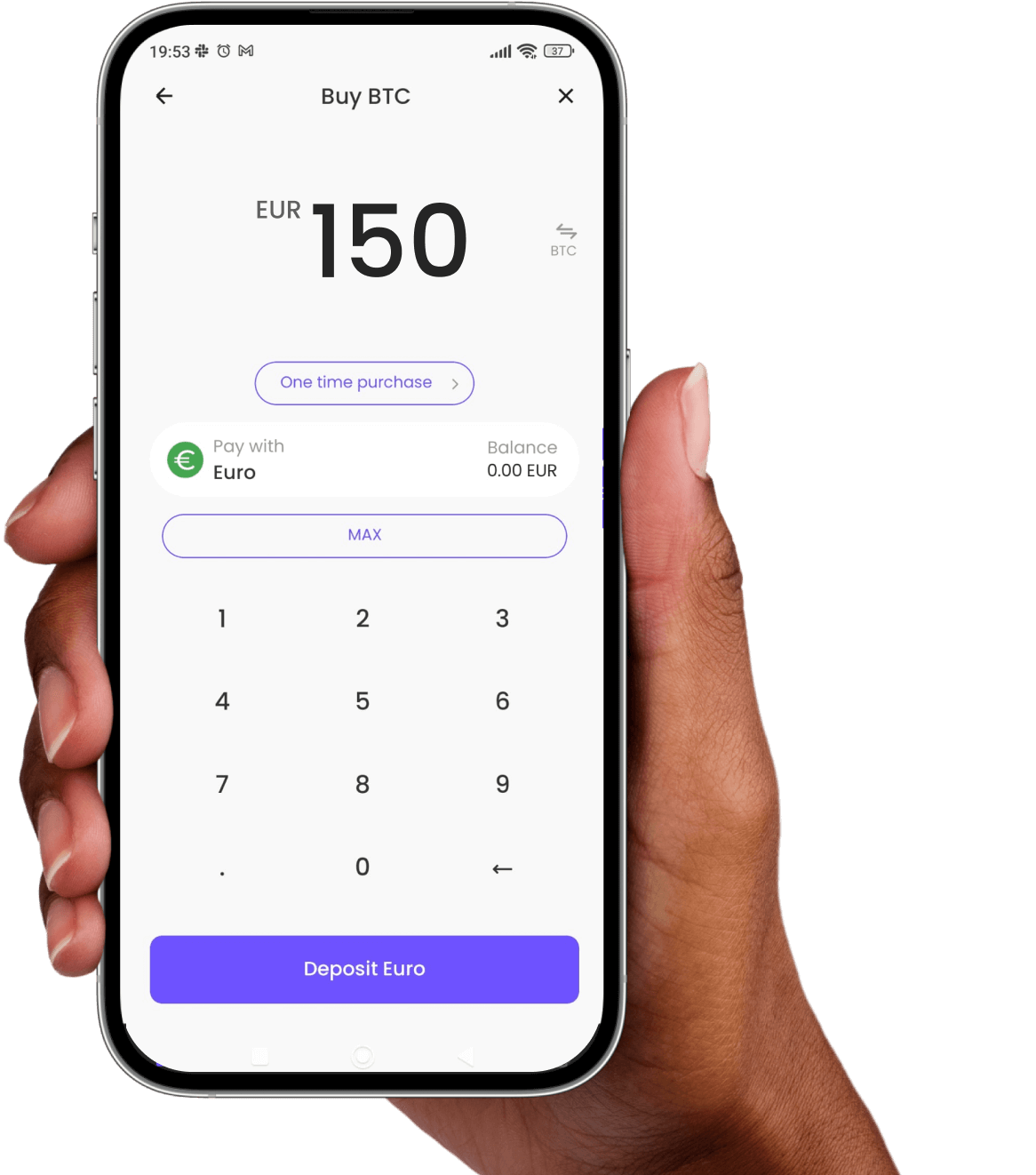

Buy Litecoin

Click on the Kriptomat icon and select “Buy”. Choose Litecoin from the list of cryptocurrencies. Enter the amount, preview transaction and confirm your purchase. You now own Litecoin!

IOS

IOS Android

Android