What is the difference between a centralized and a decentralized exchange? Why would you use one instead of the other?

Why is Kriptomat a centralized exchange and how is it different from a decentralized exchange? Read on to find out.

What is a DEX?

A decentralized exchange is a market that doesn’t rely on a third-party service to hold the customer’s funds. Trades occur directly between users in a peer-to-peer manner via an automated process.

Like cryptocurrencies, no company operates DEXs, as they are utilizing blockchain technology. They don’t store the customers’ funds or information and only serve as a matching and routing layer for trade orders.

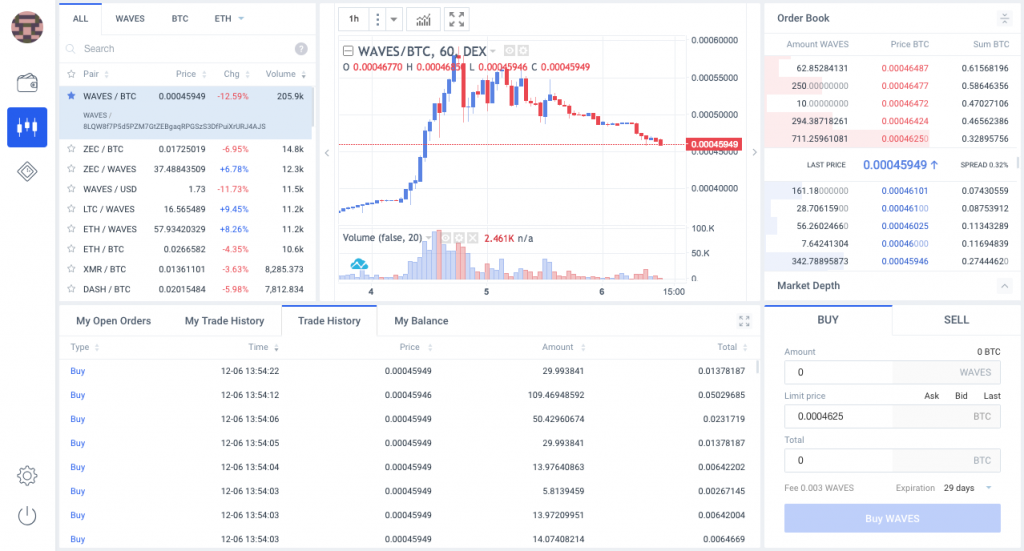

Screenshot of a decentralized exchange called Waves platform.

Some people prefer decentralized exchanges because of the very nature of blockchains and cryptocurrencies which were envisioned as community-oriented open-source initiatives.

They are generally much more difficult to use, have limited functionality compared to centralized exchanges, and are characterized by lower trade volume. And most importantly, users cannot use fiat money (EUR, USD, etc.) to buy cryptocurrencies.

Every user has to have a separate account or wallet on a centralized exchange where they can deposit fiat money and withdraw fiat money once they wish to exit. We can say without hesitation that centralized exchanges are the entry point into the world of crypto.

What is a centralized exchange?

A centralized cryptocurrency exchange includes intermediaries such as companies that act as middlemen to conduct transactions. These platforms function like traditional brokerage or stock markets.

Centralized exchanges are necessary because they represent a fiat gateway, giving users an opportunity to make transactions with traditional (fiat) money.

Centralized exchanges are also more user-friendly and users usually don’t have access to exchange accounts’ wallets and private keys.

A centralized exchange like Kriptomat must follow the regulations and perform identity verification of its users. This is something that decentralized exchanges don’t do.

Transactions are made through the mechanisms provided and approved by a central authority which oversees its day-to-day operations like maintenance, security, and growth.

Centralized exchanges can offer security that individuals can hardly accomplish on their own.

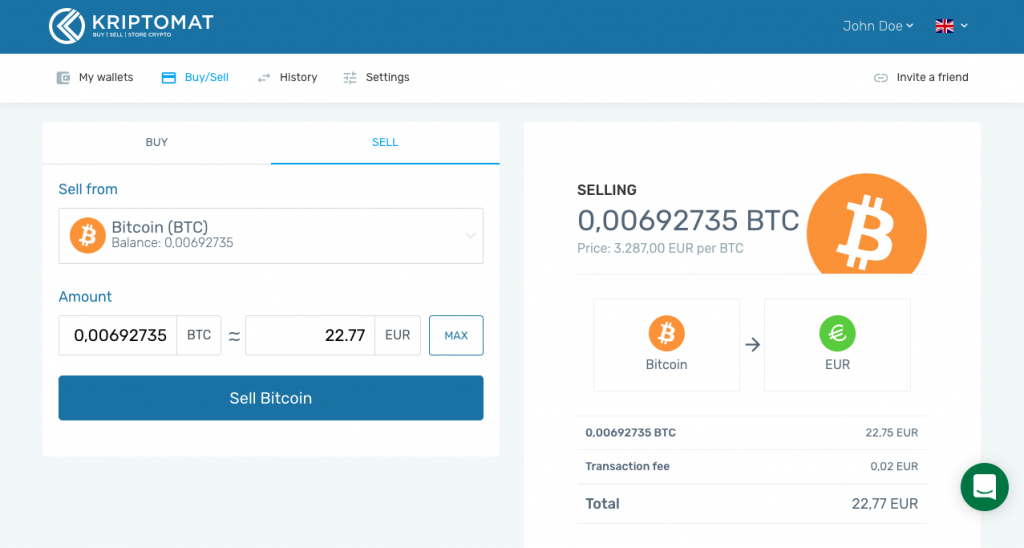

Screenshot of Kriptomat – a centralized platform.

Due to the very nature of most cryptocurrencies, an individual might lose access to all of their funds simply by forgetting the key to a private wallet.

A centralized exchange will keep the holdings in place of the individual investor and will, in some ways, resemble a bank. However, users can still freely transfer the funds from the exchange to their own private wallet.

Kriptomat is a centralized exchange

First of all, you can use Kriptomat to buy Bitcoin and other cryptocurrencies with euros. You can also use wire transfer and credit cards. It is a mixture of the traditional financial industry and financial technology.

While we do think that decentralized exchanges have their place in the crypto-to-crypto market, we strongly believe that in order to provide the best fiat-to-crypto exchange, it has to follow the relevant laws. Doing so gives the service a stamp of security, transparency and a solid ground. It is a matter of usability, security, transparency, trust, and predictability. Here is why.

Sourced from here and modified.

Centralized exchanges provide a better user experience

The problem with current decentralized exchanges is that they provide (in most cases) a terrible user experience and unintuitive interfaces. In a centralized exchange, you press buy or sell and things happen in the background while in a traditional decentralized exchange, there are multiple transactions involved to exchange one cryptocurrency for another cryptocurrency.

Centralized exchanges provide more payment options

Decentralized exchanges are usually crypto-to-crypto only, which means that there are limited payment options because you can only trade one cryptocurrency for another (i.e., you can’t use euros to buy bitcoin).

You can only deposit crypto funds to a decentralized exchange, whereas with centralized exchanges you can also deposit fiat money from your Debit card, Credit card, and Bank account via SEPA. This is due to the very nature of the fiat world that only has centralized gateways.

Centralized exchanges provide better liquidity

One of the main problems of current decentralized exchanges is that they are illiquid, which means that there are generally few participants and a low volume of activity. They simply don’t have enough sellers that could pull in a significant amount of buyers.

For example, if you want to buy 1000 euros worth of Bitcoin, you will have much better chances of actually acquiring it on a centralized exchange because it will have enough volume to actually fill your order.

Centralized exchanges offer security in the form of legality and regulations

The core value proposition of a decentralized exchange is allowing for counterparties to trade directly among each other on-chain. Such exchanges are not dependent on a centralized trading exchange and taking on the associated custody risks with handling fiat money and custody of the crypto assets.

Centralized exchanges will normally offer a wallet where users can store assets. Decentralized exchanges don’t do this and therefore exclude the risk of keeping providing safety for wallets users’ funds in custody.

Kriptomat offsets this risk by providing a service that is licensed and regulated by government institutions which give you peace of mind that your funds are being handled with extreme care.

Caring for the user is one of our main values.

Centralized exchanges offer better customer support

Credit has to be given to some decentralized exchanges for providing good support as well, but you will generally be left to your own devices when trying to figure things out and finding an external place to store and keep your assets safe (wallet).

Centralized exchanges, on the other hand, will be able to provide a good, understandable, multilingual and easy to use service, official customer support staff, safe storage (wallet) and a possibility to use your bank account or a credit card to enter the world of crypto.

Conclusion

In summary, a centralized exchange provides:

- A better user experience

- More payment options via a fiat gateway

- Better liquidity

- Security (if regulated)

- Better customer support

Ultimately, we believe that centralized exchanges satisfy the needs of a majority of users. They have a lower barrier of entry because they enable buying crypto with fiat and withdrawing the gains back to fiat using payment integration with banks and various other service providers.

Decentralized exchanges are mostly used by experienced traders who may wish to stay anonymous and seasoned traders who seek the very lowest fees and are willing to overlook liquidity and other issues.

There are benefits and downsides in each of the two models, so we believe that centralized and decentralized exchanges will always co-exist.

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android