At Kriptomat, we are committed to providing you with professional-grade tools in a simplified, easy-to-understand way to track your crypto portfolio. We have recently upgraded the calculation engine behind your portfolio performance charts.

This update changes the method we use from “Money-Weighted Return” to Time-Weighted Return (TWR).

⚠️ Important: Your Balance Has Not Changed

Before we explain the details, we want to be absolutely clear: Your actual account balance and asset holdings remain exactly the same.

- The amount of Crypto and Euro you hold is unchanged.

- Your money has not moved.

- Only the percentage (%) line on your performance chart has been updated to be more accurate.

Why The Change?

Previously, our calculation method was heavily influenced by the timing of your deposits. If you deposited a large amount of money right before a market dip, the old calculation would skew your entire performance history downwards, effectively masking the performance of the assets you chose.

We have switched to Time-Weighted Return (TWR) because it separates your “banking activity” (deposits/withdrawals) from your “investment performance” (how the assets actually grew or shrank).

Visual Explanation: The Tale of Two Charts

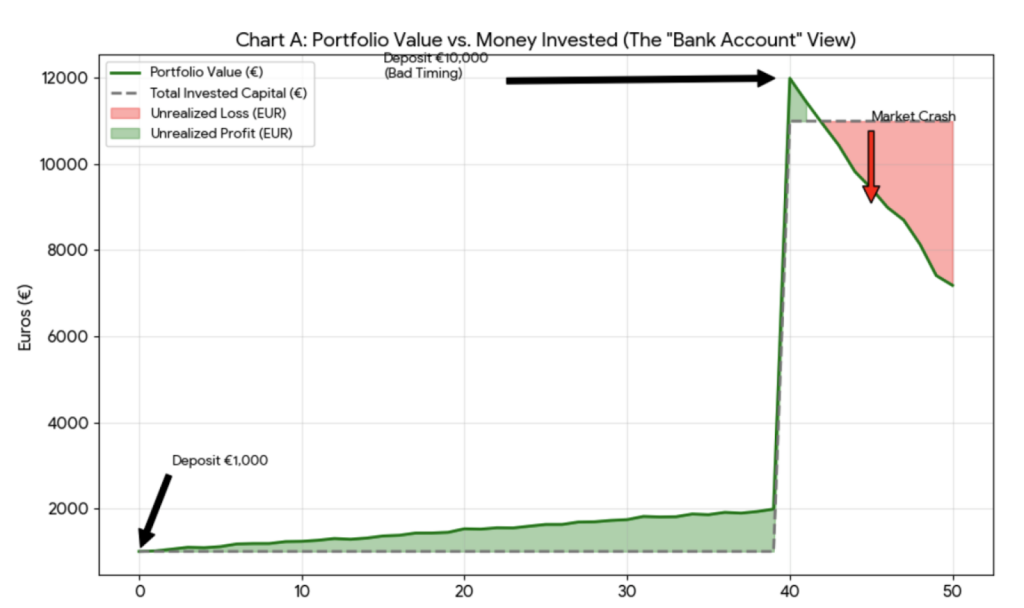

To understand why this matters, look at the two charts below. This represents an extreme scenario where a user starts small, gains profit, deposits a large amount, and then the market crashes.

Chart A: The “Bank Account” View (Reality)

Chart A shows your actual money.

- You see a green line (Portfolio Value) and a dashed gray line (Money Invested).

- In this example, the user deposited €10,000 (gray dashed line) right before a market crash.

- Because of this timing, the Portfolio Value (green line) drops below the Invested Capital.

- Result: The user has less money than they put in. This is the reality of the account balance in Euros.

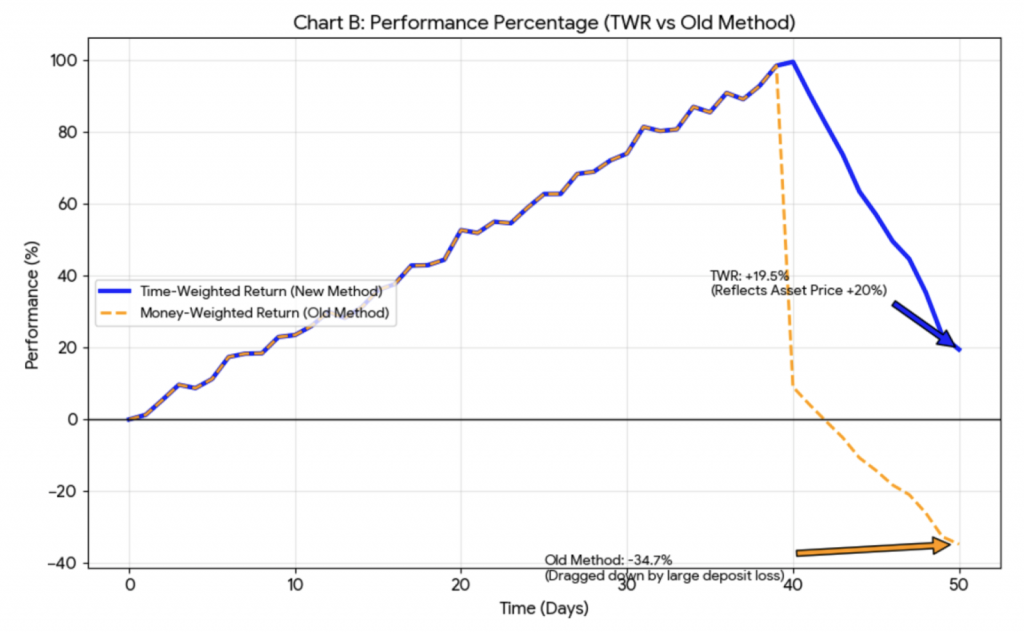

Chart B: The “Performance” View (The Calculation)

Chart B shows how we calculate the percentage score for this same scenario. This is where the upgrade happens.

- The Orange Line (Old Method): This line crashes to -34.7%. Because the user lost absolute Euros in Chart A, the old method drags the performance percentage down with it. It focuses heavily on the cash flow timing.

- The Blue Line (New TWR Method): This line stays positive at +19.5%.

Why is the Blue Line (TWR) correct?

Even though the user lost money on the second deposit, the assets themselves are actually performing well.

- The asset price started low (Day 0).

- It went up significantly (Day 40).

- It dropped, but it is still higher than it was at Day 0.

TWR (The Blue Line) correctly identifies that the assets in the portfolio have grown over time, regardless of the unfortunate timing of the large deposit. It measures the performance of your portfolio strategy, not the timing of your bank transfers.

One More Fix: Cleaning up “Dust”

Along with TWR, we have solved the issue of “Dust.”

In crypto, you often have tiny fractions of a cent left over after a trade. Previously, if €0.008 grew to €0.016, the system might show a massive +100% spike on your chart.

The new system filters out these tiny balances, ensuring your chart stays smooth and meaningful.

Summary

- Old Method: Measured how your cash balance changed (influenced by when you deposited).

- New Method (TWR): Measures how your chosen assets performed (influenced by market price).

This upgrade brings Kriptomat into alignment with professional investment standards, giving you a true picture of your investment success.

Happy Trading!

The Kriptomat Team

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android