Even if you’re new to the cryptocurrency market, I would guess that you’ve at least taken a peek at the popular crypto-price tracking websites like coinmarket cap or its numerous cousins. These websites display all sorts of information about cryptocurrencies that are being traded in various markets. In this article, we will cover all the basics of these websites and explain the various metrics they display.

TABLE OF CONTENTS

Coinmarket basics

Let’s first improve our crypto vocabulary by getting to know some basic terms. If you have ever wondered how to determine the price of a particular crypt and where the terms “market caps” come from, then you came to the right address.

What is market capitalization and how is it determined?

You will probably notice that cryptocurrencies are most often ranked by market capitalization. What does this mean?

Market capitalization is the mainstream way of ranking cryptocurrencies by their market share. It is calculated by multiplying the current price with the circulating supply (also available supply). The equation is very simple:

Market cap = (Current price) * (number of available coins)

Let’s imagine the following scenario. Say that you create a new currency with a fixed supply of one hundred coins, and let’s say that people are willing to pay 0.50 euros for one coin. In this case, the coin market share of your currency is 50 euros. If someone buys your coin for 1 euro, this would raise the coin market cap to 100 euros.

Take Bitcoin as an example. Its current price at the time of writing this article is 3035 EUR, while there are 17,518,375 Bitcoins in circulation. By multiplying these two figures, we get a market share of 53 billion euros.

Bitcoin market capitalization = 3035 EUR * 17,518,375 = 53,168,268,125 EUR

The total market capitalization of all cryptocurrencies currently stands at around 100 billion euros, and Bitcoin’s market share is around 53% (because it has a market cap of 53 billion).

Bitcoin has had a dominant market share for almost a decade since its inception in 2008. The reason is that there were very few cryptocurrencies in this period. Bitcoin was effectively the only relevant coin in the world of cryptocurrencies. When they started to multiply in numbers, Bitcoin’s market share naturally started to decline, but it was never knocked off first place.

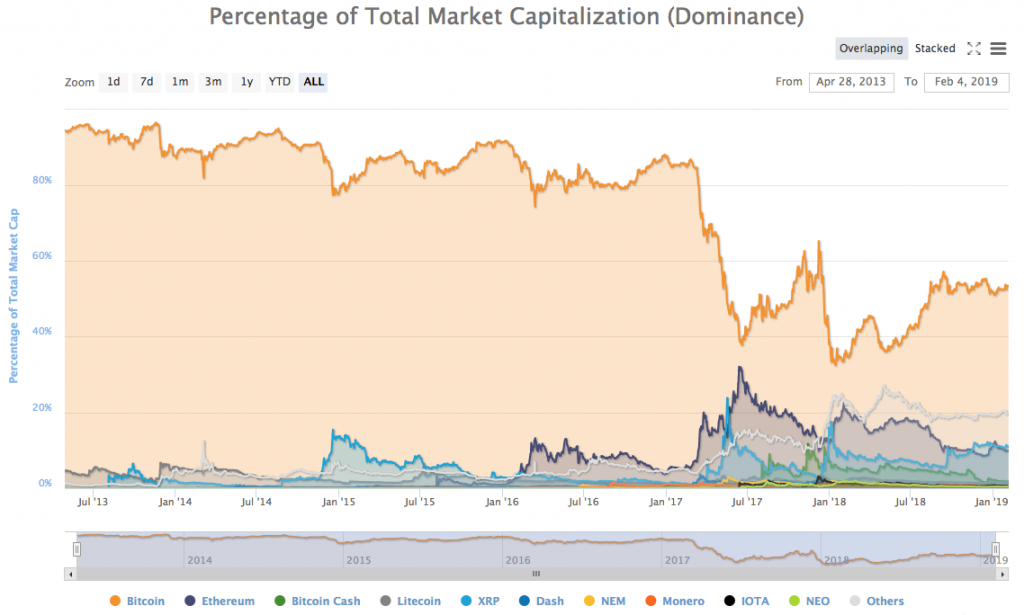

The market share of the most popular cryptocurrencies expressed in percentages. It is calculated by taking the market capitalization of the cryptocurrency and dividing it with the total market capitalization of all cryptocurrencies combined. We can see that Bitcoin is still on top, but its share dropped off in the last couple of years due to the boom of the entire crypto market. Image source: coinmarketcap.com.

In January 2018 Bitcoin’s market share was 32%, which was the lowest point in its history. That was when the whole crypto market was soaring to all-time high prices and ICO projects were extremely popular. As a result, it was logical that Bitcoin’s share became smaller. In the middle of 2017, Ethereum even threatened Bitcoin’s dominance for a brief period of time, but Bitcoin gradually regained its dominance.

How is the price of a digital currency determined?

So how do we actually determine the exchange rate of different currencies? The answer is very simple. The price is determined on the basis of a number of sometimes unpredictable factors that ultimately influence the supply and demand of the market.

Again, let’s take Bitcoin as an example. Rarity has been hardcoded into the system as there are only 17.5 million coins in circulation, while the final supply is expected to stop in 2140 at exactly 21 million coins. This is a very small number, especially in comparison with traditional currencies. Bitcoin can be divided into 8 decimal places, and the smallest unit is unofficially called satoshi. It is a one hundred millionth of a single bitcoin or 0.00000001 BTC.

Bitcoin also has certain features that make it popular and makes people attribute a certain value to it. Among other things, it is the first real global payment system and decentralized digital currency that enables or at least promises a better future, especially for those who don’t have access to world banking.

What I specifically have in mind is people from Third World countries or countries with hyperinflating national currencies. Cryptocurrencies give them the ability to more easily participate in the global financial system. On the other hand, some people see cryptocurrencies as an opportunity to break free from centralized institutions, while others see it as an investment opportunity …

All these elements create the conditions for determining the price on the basis of supply and demand.

But the price can change very quickly. This is called instability or volatility. The crypto market cap is still relatively small compared to some other industries.

Check out the prices of our available cryptocurrencies.

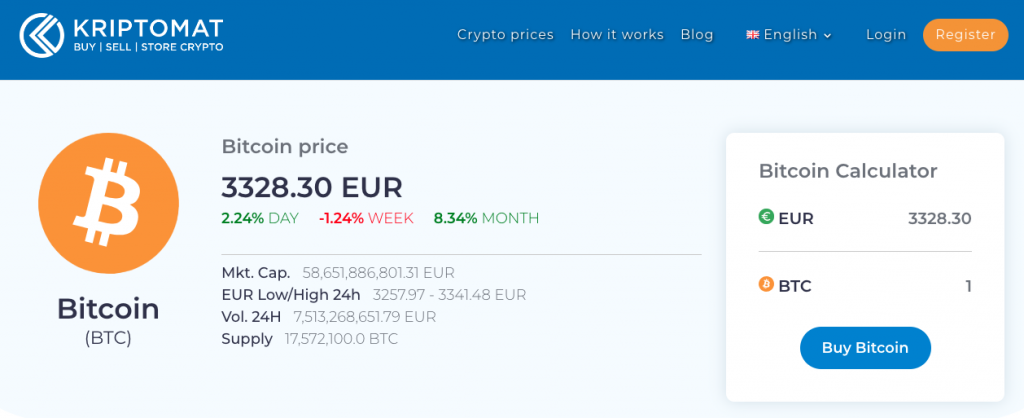

Here we can see all the basic data for Bitcoin (BTC). The most prominent number is the price (“crypto stock”). The coloured numbers beneath indicate the price change in the last day, week, and month. Then there is the market capitalization (Mkt. Cap.), and the lowest and highest price in the last 24 hours. “Vol. 24H” indicates the volume of trading in the last 24 hours. The supply shows the current number of coins that are already in circulation. On the right-hand side, you can see a calculator for conversion between Bitcoin and euros.

What is available supply?

I think this term is quite self-evident. It’s simply the total number of coins currently in circulation. We could also say that this is the number of coins on the market, but technically this is not quite true. The number of coins that are actually being traded is always smaller than the total number of coins. This is because many people keep their coins on private wallets, making them completely detached from the market.

A lot of the cryptocurrencies still don’t have all coins in circulation. In most cases, it will remain so for quite some time, mostly due to mining mechanisms. The issuance of crypto coins is divided into three basic categories.

1. Fixed supply

The first category includes cryptocurrencies which have a complete and fixed supply of coins available since they were first issued (sometimes called a “premine”, meaning that they are mined in advance). This category includes cryptocurrencies with a planned fixed final supply, where coins are periodically released into the market by a variety of different methods. Bitcoin does it through mining while a cryptocurrency like Ripple (XRP) releases coins periodically from a cryptographic lock.

2. Mining

The second category includes most well-known cryptocurrencies are those where the supply is controlled through the mining process. There are several different ways to issue coins via the mining process. Some cryptocurrencies gradually increase supply over time, but the supply is limited. This is the case with Bitcoin (BTC). Other mined cryptocurrencies have a theoretically infinite supply but the issuance of new coins is projected to slow down over time. An example of such a cryptocurrency is Ethereum (ETH), but — given further developments — this can still be changed.

Read more in our article about crypto mining.

3. Unlimited supply

The third category includes cryptocurrencies with an unlimited supply. They are similar to the usual fiat money because this creates inflation. This is not necessarily a negative feature, but let’s leave this topic for another time, as it is a complex economic debate. An example of such a cryptocurrency is Dogecoin (DOGE).

Some crypto comparison websites also show you the theoretical market capitalization of a cryptocurrency if all coins were already in circulation. This metric is somewhat misleading because the dynamics of supply and demand would be completely different in such a scenario.

However, it can be an interesting speculative tool. For example, we mentioned that Bitcoin has always been dominant on the basis of the cryptocurrency market cap, but the theoretical market cap of XRP briefly reigned supreme in January 2018.

Other standard metrics

Let’s take a look at some of the other metrics you might see on market cap websites.

Volume

The volume displays the total amount of cryptocurrencies that have been exchanged over the course of the last 24 hours. In other words, it is the combined volume of buys and sells on a particular market in a given time frame. It can be the sum of multiple markets.

Cryptocurrencies with a higher market share usually have a higher volume of trading, which makes them safer investments, at least in theory. This is because they have higher liquidity and it is tougher to move the price up or down.

This graph shows Bitcoin’s price movement in a given time period. In this case, we are looking at the price of Bitcoin in the last month. You can choose between six preset periods (day, week, month, 3 months, 1 year, all time). You can also set any desired period with the slider. The green columns at the bottom of the graph show the daily volume.

Change

This is a change in the price of a currency over a given period of time (e.g. one hour, one day, one week, etc.). It’s usually shown as a percentage.

For example, if the price drops from 100 EUR to 50 EUR in the last week, then the change will be displayed as -50%.

Most charts will show a change in the last hour and the day, but it is also useful to check other time frames.

Which time frame you focus on will depend primarily on your interests. Experienced traders are usually interested in short-term periods, while experienced investors are usually more interested in long-term periods of time.

Different coin prices on different platforms

You may have noticed that the prices of cryptocurrencies can differ between different exchanges and trading platforms. Why is this so?

You can imagine every trading platform as its own separate island with its own supply and demand which ultimately sets the price of each cryptocurrency. They have an order book and the price is represented as a value of the coin on the market. This price is determined at the meeting point of buy and sell orders. Some people have buy/sell orders at lower prices and some have them at higher prices.

The prices shown on crypto comparison websites are an average of multiple different markets, so they should not be taken at face value!

Find out more in our article about different types of exchanges.

Conclusion

We hope this article gave you a better understanding of the information that is most often shown on various crypto comparison sites. Keep in mind that Kriptomat provides an overview of all the necessary information for all the supported cryptocurrencies.

If you have any questions, we will be happy to answer them in the comments section below!

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android