For a beginner, entering the world of cryptocurrencies can be both exciting and overwhelming. Getting familiarized with the complexities of the technologies behind the currencies can be a painful process, albeit an unnecessary one if your needs aren’t that demanding.

So if you wish to buy cryptocurrencies, it is good to understand the workings of crypto exchanges and their tools associated with investing, trading, security, and so on.

So let’s talk about some things that you need to know about crypto exchanges, which you probably won’t hear from anyone. 2019 may very well bring increased adoption of cryptocurrencies, especially with the help of more user-friendly platforms.

Difference between a trading platform and an exchange

At their core, there are two basic types of crypto exchange services. There are exchanges where you can convert fiat into cryptocurrencies and vice-versa; and then there are the more advanced trading platforms where you can trade, usually with the additional layer of various complex trading tools, where the buyers and sellers set the supply and demand. You can see it as a virtual place similar to the stock exchange (such as Nasdaq).

As one might expect, different kinds of exchanges cater to different kinds of needs. Someone who merely wants to buy cryptocurrencies in a simple way with euro has different needs than a person who wants to regularly trade and exchange one currency for another.

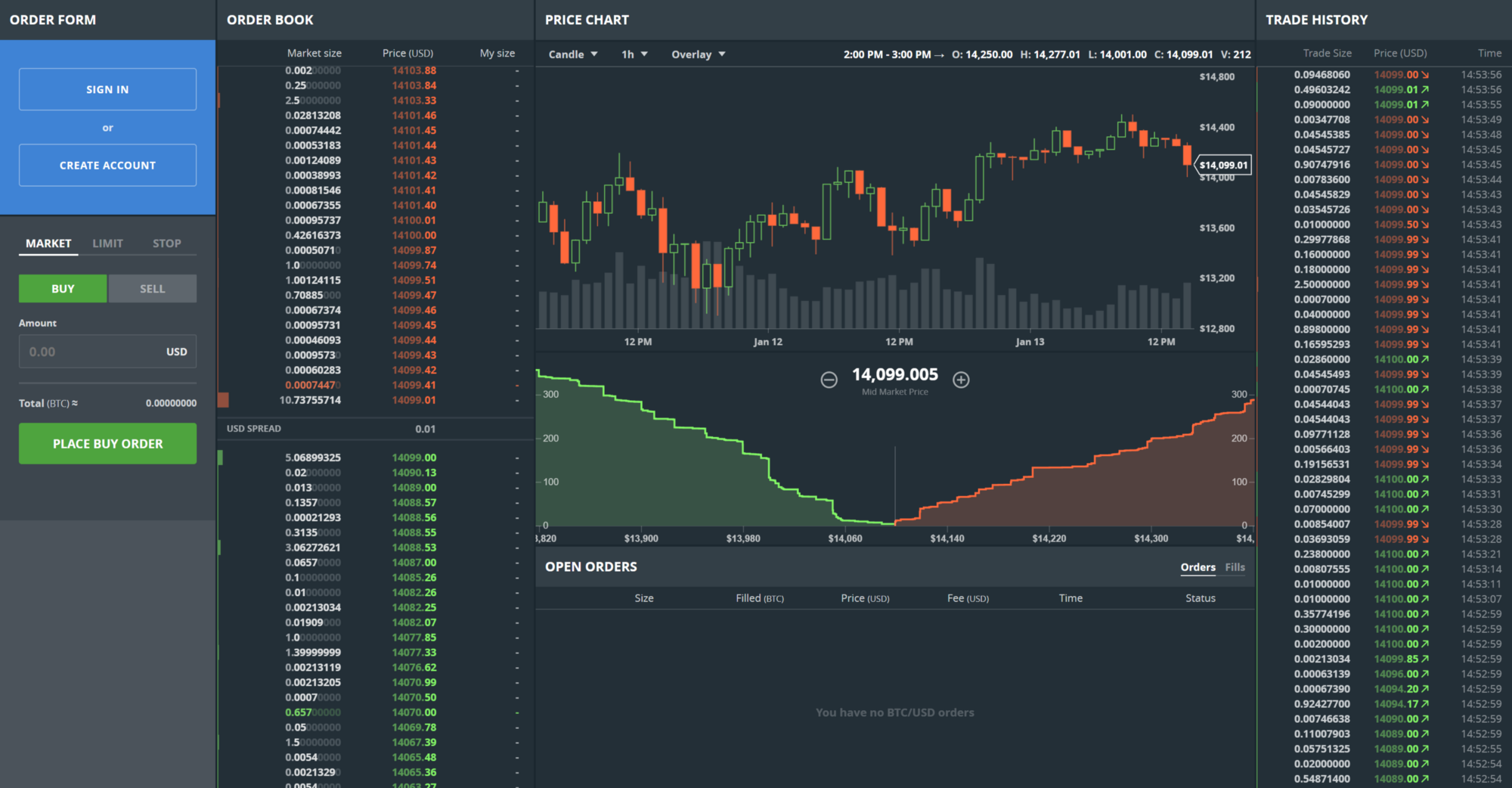

A typical example of a trading platform.

Just to be clear, Kriptomat is not a trading platform, but an exchange. It could also be called a fiat gateway where you can use euros to directly buy or sell different cryptocurrencies. Our mission is to enable complete beginners to enter the world of cryptocurrencies, so our service offers greater ease of use compared to trading platforms.

The challenge and biggest difference here is that trading platforms are usually complex and hard to use for beginners, whereas exchanges can have a more user-friendly interface. Keep in mind that when you see an order book (see the picture above), you have probably entered a trading platform.

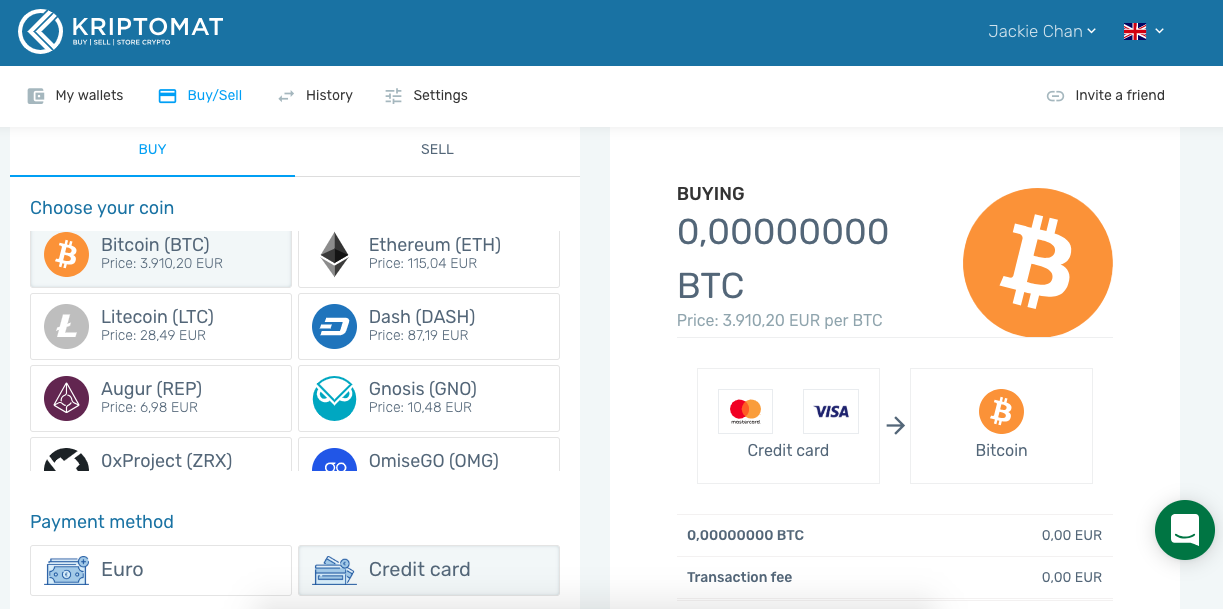

If you see a Buy/Sell options on the platform, with no trading book, you have most probably entered an exchange (pictured below).

Kriptomat – the example of an exchange.

Different prices of coins on different platforms

As you might have noticed, the prices of cryptocurrencies can differ widely from one exchange to the next. The prices also vary between exchanges and trading platforms (such as Bitstamp, Kraken, etc.). Why is this, you might ask?

How the price is determined on a trading platform

Each trading platform is its own separate island with its own supply and demand which ultimately sets the price of each cryptocurrency. They have an order book and the price is a value of the coin on the market. This price is determined as being where buy and sell orders meet. Some people have buy/sell orders at lower prices and some have them at higher prices.

Buyers who don’t need bitcoins immediately are most interested in obtaining bitcoins at the lowest possible price. Sellers not needing cash immediately are then most interested in obtaining the highest possible price.

How the price is determined on an exchange

Exchanges usually have suppliers of coins, meaning that they buy coins for a wholesale (market) price and then sell them for a higher (retail) price. They also add fees on the top of the price. This is simply because they purchase the coins elsewhere and then resell them to their customers.

What is critical to understand here is that some exchanges then significantly raise their prices of bitcoin and other currencies. Let’s say that you want to buy 100 euros worth of bitcoin. At the current market price (let’s forget the fees for now), you would get around 0.026 BTC. Now let’s compare exchanges such as Kriptomat, Indacoin, Coinmama, and Coinbase. At the time of writing this article, the bitcoin selling price is:

- Kriptomat: 3.842 EUR*,

- Indacoin: 4.784 EUR*,

- Coinbase: 3.864 EUR*,

- Coinmama: 4.092 EUR*.

*The prices were taken directly from their websites on 20 November 2018.

Do you see the difference? This means that each exchange sets its own retail price. And for what we have seen so far, Kriptomat is among the lowest on the exchange market right now.

As already said, this is the price you pay for your coins on different exchanges. Kriptomat strives to set the price that the users would get on the original marketplace — or trading platform. You can see that there is not only a fee that determines, how much coins buyer would get. But we have just shown you that the price is an important element as well.

“People mistakenly assume that the prices shown on crypto-comparison websites are actual market prices, when in reality they are more or less just displaying an average price from different exchanges.

This means that the prices on exchanges will always be slightly different from the prices shown on crypto-comparison sites. However, so far Kriptomat is amongst the ones with the lowest selling prices. Still not convinced to buy your crypto at Kriptomat? Read further.

Different fees

So, now that you have an idea of how the price of the Bitcoin and other cryptocurrencies is created, manipulated and determined, and how every exchange is selling them at a price they set for themselves, you can see that it is not only the fees that should be taken into account when choosing an exchange where you will buy, sell and store your assets. In this chapter, we will make a comparison of the current fees on different exchanges, and why you will find services with fees approaching 10%.

First of all, fees normally include expenses of the platform for KYC verification, bank fees, transaction fees, gas, etc. A big factor here is how much a certain platform is paying for these outsourced services.

As already explained, trading platforms are where the market price is set, and their users are (more or less experienced) traders who make an enormous volume of daily trades. This way a trading platform can expect a higher volume of transactions, collect more fees and can cut better deals with their business partners.

Exchanges, on the other hand, cater to people who aren’t professional traders. Why do we resell coins to the mainstream? Because trading platforms are simply too complicated to use for a random non-technical person. That being said, exchanges offer to sell coins, set the price of coins independently and add transaction fees on the top. So what are the fees of exchange platforms that we compared above?

- Kriptomat: 1,45%*,

- Indacoin: 3,00%**,

- Coinbase: 1,49%*,

- Coinmama: 5,00%*.

*The fees were taken directly from their websites on 20 November 2018 at 16:00 CET, at the time of writing this article. These are the fees for a money transfer payment method. Fees for credit card purchases can be different. Fees can be different for different kinds of transactions. **There is no clear indication of the fee schedule, fees vary between different methods of payment and different kinds of transactions. To our understanding, the lowest fee is 3%.

See the difference once again?

The big factor here is that many platforms do not give you the fee price in advance but just deduct the fee from your payment. Our advice is to never make a purchase where the price of the coin you wish to buy and the fee you will pay are not transparently disclosed in advance.

Credit Card issues

In many ways, the crypto world is still a Wild West and it may remain so for quite some time, despite the ever-increasing government efforts of a more strict regulation. As a result, financial services like MasterCard and VISA are classifying transactions related to crypto as high risk, and in doing so, placing a restriction on how anyone can buy cryptocurrencies with their credit cards.

These measures are put in place as a result of the lack of compliance with the national and international regulations, lack of proper KYC (Know Your Customer) and AML (Anti Money Laundering) procedures on the part of many crypto businesses (not just exchanges, but all sorts of other service providers and ICOs).

This presents an issue because financial institutions are required by law to know the identity of their customers, especially when dealing with fiat money (EUR, USD, etc.).

Kriptomat derives the transparency and truthfulness from its licenses and full compliance with the regulations. We implement strict and compliant KYC and AML procedures. It may sometimes be too overwhelming for users to share their personal data, however, we believe it is for the benefit of both parties. More to that, our internal bylaws, compliance officers and the legal team makes sure to keep your personal data safely stored, in accordance with the GDPR Regulation. Any user who wishes to delete their personal data can send a request at any time to [email protected].

KYC and Regulation

Due to the complex technology behind most cryptocurrencies, one must take extra security measures to protect their funds.

What is KYC, for those who are still unfamiliar with the term? It is a due diligence procedure where the user presents us with certain personal data in order to verify his or her identity. Why do we need to do this? Because the only way to keep our service, platform, and business safe is to eliminate fraud, forgery, black money, identity theft and other cases of financial crime. The only way we can protect ourselves, our users, and fight against such threats, is to know who our users are.

So, the KYC represents the process of verifying the identity of our clients in order to prevent money laundering, identity theft, financial fraud, terrorist funding etc. When using exchanges, always try to determine its KYC practices and licenses.

The fact is that if a service has a mandatory KYC procedure before any money is transferred, then such a platform can be, in our opinion, more trusted than services where you can buy crypto without performing any KYC.

Kriptomat, for example, was established in Estonia as it is one of the most progressive technological regulators. The platform has been issued two operating licenses by the Financial Intelligence Unit for Providing services of exchanging a virtual currency against a fiat currency and for Providing a virtual currency wallet service.

Every exchange has different levels of regulation, which means that you should be mindful of where you are going to purchase, sell and, most importantly, store your crypto and fiat assets.

Bear in mind that the KYC verification has nothing to do with paying taxes, reporting to tax authorities or reporting to other authorities, unless there is a potential case of money laundering, terrorist financing, identity theft, fraud, and such cases.

Like it or not, the cryptocurrencies world is getting increasingly regulated — as contradictory as that might seem to the early adopters.

At the end of the day, it is still extremely important to take appropriate safeguards to ensure your assets (crypto or fiat) are safe. Our stance here is that a more regulated and compliant service will give you better protection and a better sleep at night. 🙂

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android