Across Europe, searches related to cryptocurrency reach a significant amount of traffic every month. And while Cryptocurrency is a hot topic, it can be complicated to understand if you are new to the world of digital money.

For those looking to understand the world of cryptocurrency, our crypto experts at Kriptomat have taken a deep dive into the most asked cryptocurrency related questions across Europe and provided answers for those desperate to know more.

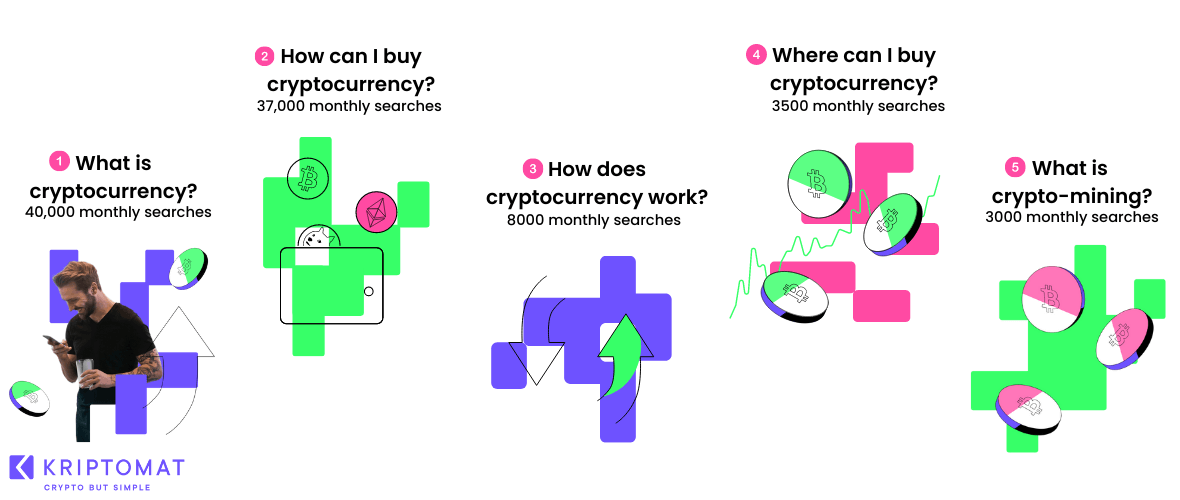

1. What is cryptocurrency?

40,000 monthly searches across Europe

Cryptocurrency is a form of digital money. It’s based on a 2008 technical paper published online by a person or collective using the name Satoshi Nakamoto. The objective of the paper was to describe a secure and accessible financial system that could operate independently of traditional financial institutions like central banks and government.

Satoshi’s whitepaper was the foundation for Bitcoin, the first modern cryptocurrency. It was launched in 2009.

Since then, thousands of cryptocurrencies have been created. They are bought, sold, and traded online at exchanges and platforms like Kriptomat. Crypto transactions are recorded securely and anonymously on a public ledger called a blockchain, which is maintained by a network of computers around the world.

Some of the most popular cryptocurrencies include Bitcoin, Ethereum, and Litecoin.

2. How can I buy cryptocurrency?

37,000 monthly searches across Europe

Cryptocurrency is bought and sold online.

Once you have set up a hardware or software crypto wallet and made it the custodian of your private and public cryptographic keys, you can purchase crypto at a Bitcoin ATM, a peer-to-peer trading site, a decentralized crypto exchange (DEX), or a full-service exchange platform.

Bitcoin ATMs are physically connected to the internet. They work like ordinary ATMs except that instead of issuing paper currency you can carry away, they transfer it to your crypto wallet. Bitcoin ATMs charge relatively high fees and most sell only Bitcoin.

Individuals with crypto to sell post notices at peer-to-peer websites, where you can browse the offerings and compare them. Some allow both buyers and sellers to be anonymous.

Decentralized crypto exchanges, or DEXs, are websites with software that matches buyers and sellers. You must establish a crypto wallet before you can do business with a DEX.

Most users prefer a simple and trustworthy investment platform. That’s why most crypto purchases are made at regulation-compliant exchanges and full-service platforms like Kriptomat, which handle the complexity of public-key cryptography and blockchain technology for their customers.

3. How does cryptocurrency work?

8000 monthly searches across Europe

Modern cryptocurrency relies on blockchain technology. A blockchain is an online database that records every transaction since the cryptocurrency was created. The Bitcoin blockchain maintains a permanent record of every Bitcoin transaction. The Dogecoin blockchain records Dogecoin transactions. Transactions are validated before they are added to the blockchain.

Every crypto user has an anonymous address on the blockchain. When someone sends cryptocurrency to you, your crypto platform or wallet can calculate and display your balance. You can send crypto to anyone whose blockchain address you know.

Once they are recorded on the blockchain, crypto transactions can’t be erased or altered.

If you wish to make a purchase from a crypto-friendly retailer, use your crypto platform or wallet to specify the amount and the recipient’s address. Addresses are lengthy strings of numbers and letters, easily mistyped. For the sake of convenience, they are often available as QR codes that can be scanned with a smartphone.

The value of any cryptocurrency is set by supply and demand based on the selling price at crypto exchanges.

4. Where can I buy cryptocurrency?

3500 monthly searches across Europe

There are four places to buy cryptocurrencies:

Cryptocurrency exchanges: Cryptocurrency exchanges and full-service platforms like Kriptomat allow you to buy, sell, and trade cryptocurrencies. The best platforms earn licenses and operating certificates where relevant and comply with government regulations to keep users and their money secure.

Decentralized exchanges: Online services called DEXs allow you to purchase cryptocurrency with processes that are automated by software. You need a crypto wallet for using a DEX. The team behind the DEX may be anonymous and the services generally do not seek compliance with government regulations. Most don’t maintain customer support teams.

Peer-to-peer marketplaces: P2P marketplaces allow you to buy, sell, and swap cryptocurrencies directly with other individuals. Some sellers are anonymous, and some are willing to sell to anonymous buyers.

Bitcoin ATMs: Bitcoin ATMs are internet-connected physical machines that allow you to buy and sell cryptocurrencies – usually only Bitcoin – using a credit card. Some Bitcoin ATMs require user verification with a government-issued photo ID.

It is recommended to use a reputable cryptocurrency platform like Kriptomat, which handles security, regulatory compliance, translation, and technical issues to make the process as secure and simple as possible.

To buy cryptocurrency at an exchange or full-service platform, you must first create an account and verify your identity. You can then fund your account and buy the cryptocurrency of your choice.

5. What is crypto-mining?

3000 monthly searches across Europe

Mining is a way to earn crypto by contributing computer power to the validation process for crypto transactions.

For example, for Bitcoin every 10 minutes, a winning mining team wins 6.25 Bitcons. That has made mining lucrative enough to support the creation of huge “mining farms” with thousands of computers that are custom-designed to validate transactions quickly and earn Bitcoin rewards. Worldwide, Bitcoin mining farms consume about as much electricity as the entire country of Sweden!

You can’t compete with Bitcoin mining farms, but you can mine other cryptocurrencies or invest in a mining group to earn a share of the rewards.

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android