Where and how to buy ()

Discover where and how to buy online. With Kriptomat, buying and other cryptocurrencies is easy, quick, and secure.

Trusted by 400,000+ users across Europe

Calculator

Buying with Kriptomat

Three simple steps to purchase with Kriptomat:

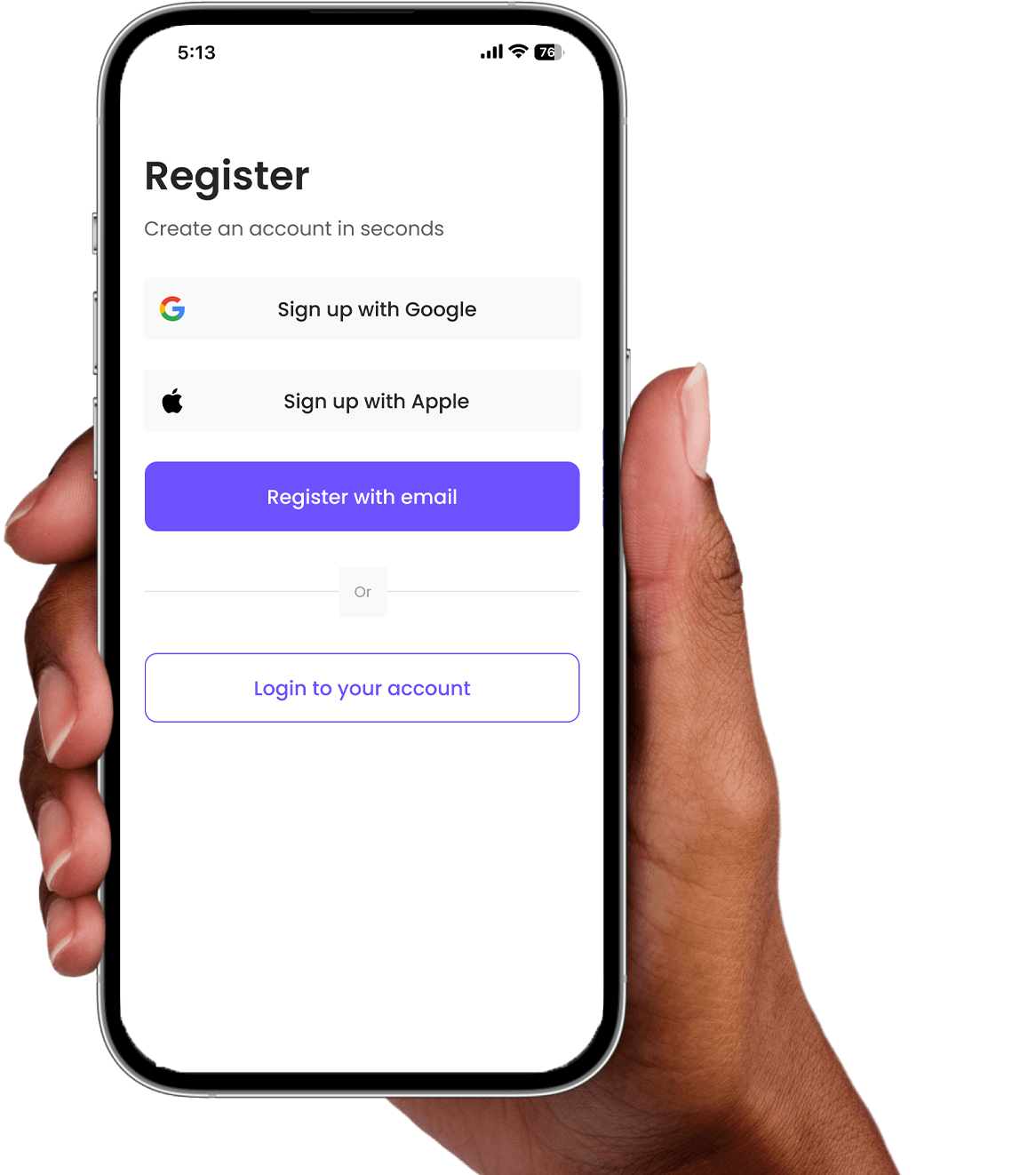

Create and verify your account

Sign up with Google, Apple or enter your name and email. Verify your email, phone number and identity. Congratulations, you have unlocked the full potential of the Kriptomat platform within minutes!

Add funds

Make a bank deposit or use your credit card to add funds even faster. Now, you are ready to buy and 350+ other cryptocurrencies.

Buy

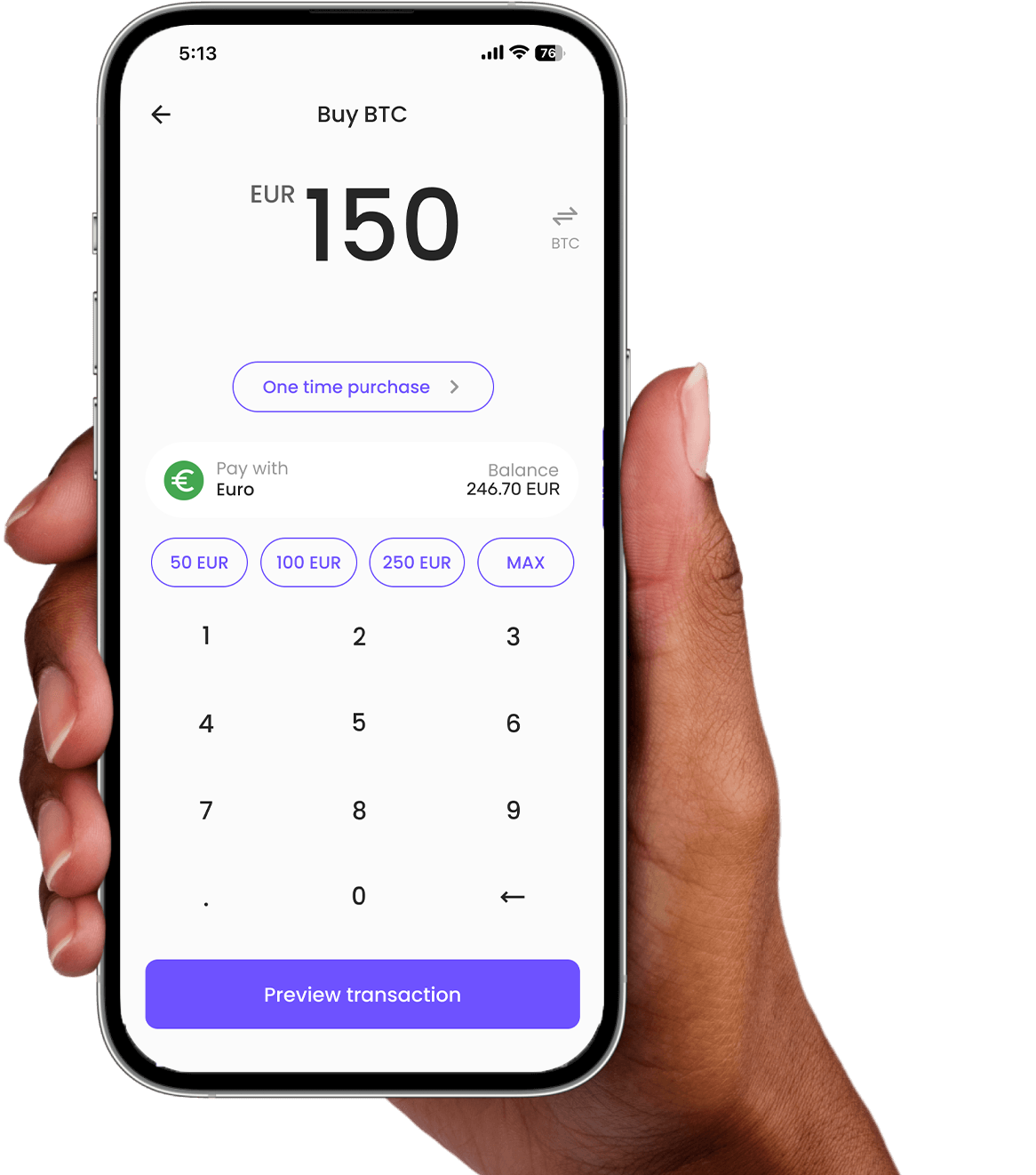

Click on the Kriptomat icon and select “Buy”. Choose from the list of cryptocurrencies. Enter the amount, preview transaction and confirm your purchase. You now own !

Your detailed guides to buying

Need more information about how to buy ?

Our mission is to make crypto accessible to everyone. That is why it is crucial to simplify buying on Kriptomat. The most popular way to get started is with our mobile app:

Prefer computers? Create your Kriptomat account with your browser and use it for all your crypto investments. We also offer several intelligent crypto investing products to help you reach your financial goals.

Have more questions? Find all our guides about buying and selling here.

Why should I buy on Kriptomat?

Live customer support

Our customer success team is ready to deliver fast, friendly assistance and explanations in your language.

Top coin selection

We offer immediate purchase of popular coins and tokens, including .

Suitable for complete beginners

We focus on simplicity to ensure you quickly master our platform and become a confident crypto investor.

Safe storage

Upon purchase, we provide a secure and reliable offline storage solution, ensuring the safety of stored .

Payment methods

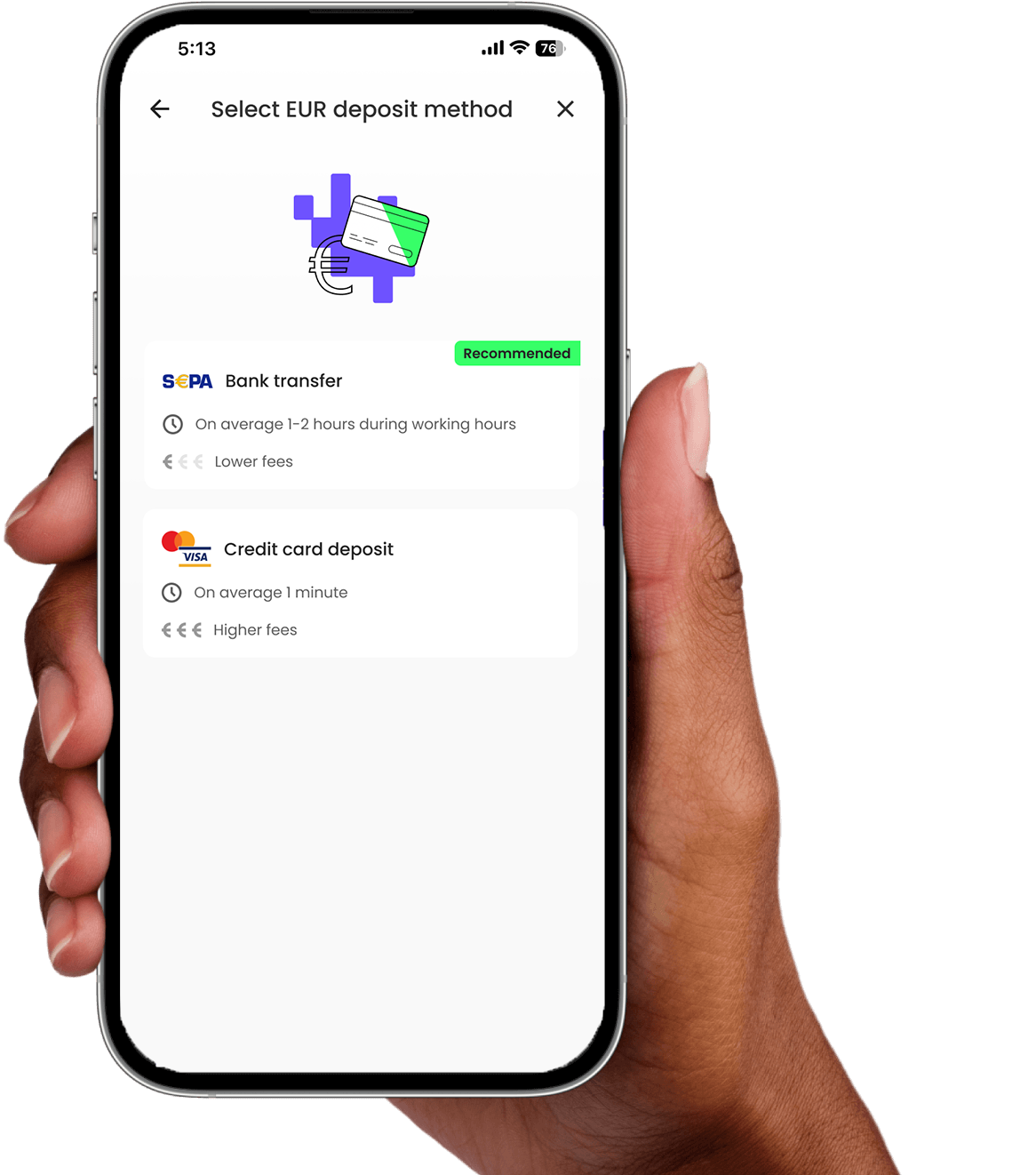

When purchasing with EUR on Kriptomat, you have access to various completely secure options:

Buy with a bank deposit

Safely and conveniently transfer funds via bank deposit with Instant SEPA support. You can buy with your EURO balance.

Buy with a debit or credit card

No time to wait for bank transfers? You can instantly buy with your credit card.

Buy with Skrill

Are cards and banks not your style? Skrill offer another alternative payment method for buying .

How and where to store

Once you buy on the Kriptomat platform, we seamlessly transfer it to your dedicated and secure wallet within our platform. Each user receives an individual wallet.

To protect our customers and their funds, we offer secure offline storage and conduct regular security audits. This approach makes our platform a haven for storing and other cryptocurrencies.

What can I do after I buy ?

Keep your investment safe and track its growth on Kriptomat.

Exchange your for other cryptocurrencies on Kriptomat to effortlessly diversify your portfolio.

Sell your for euros and seamlessly withdraw the money back to your linked bank account or card.

Smart strategies for buying with Kriptomat

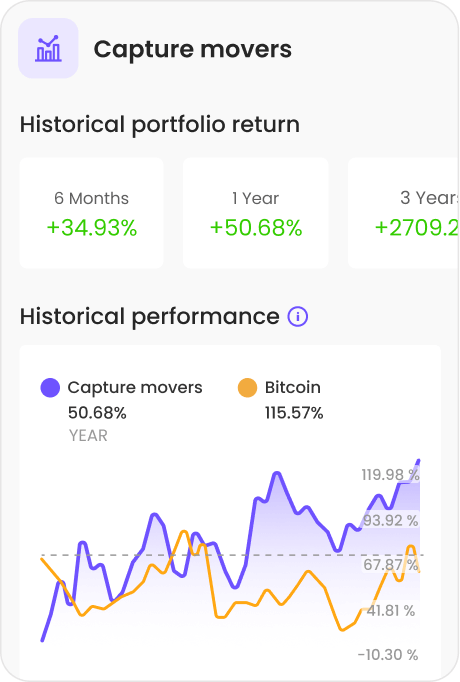

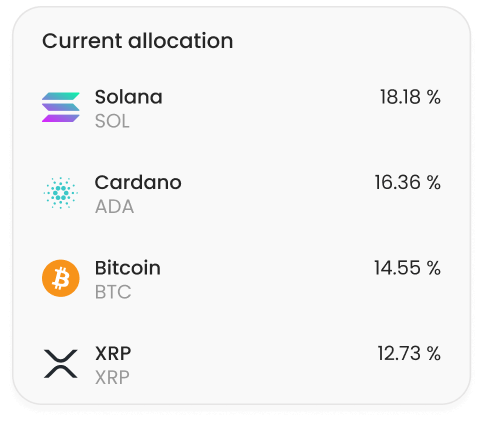

Buy through Intelligent Portfolios

Explore the option to buy through Kriptomat’s Intelligent Portfolios. These portfolios are designed to optimise returns by leveraging advanced algorithms and diversifying investments across various cryptocurrencies, including . By choosing a portfolio that includes , you can invest in this cryptocurrency alongside other assets, benefiting from automated rebalancing and smart management.