What kind of investor are you? Do you buy and pray for the price to rise, or do you put more thought and research into it?

Being honest with yourself and knowing the type of crypto investor you are could make you better informed about which factors to consider before clicking the “buy” button.

We believe that cryptocurrencies and blockchain technology will reinvent and revolutionize many industries, including the financial one. You can already use different tokens and coins for various utilities like buying food, properties, and travel expenses.

With that in mind, it has to be said that this is still a young industry and that a lot of people are in it purely for speculative investments. So let’s take a look at the very basic types of crypto investors, but don’t take anything in this blog as investment advice. It is meant to provide purely educational information for the general public.

1) The Beginners

They are newcomers to the world of cryptocurrencies. They probably heard about Bitcoin in one of the latest bull markets, specifically at the end of 2017. They tend to lack the specific knowledge and experience, which is why they can often be naive.

This is why it is extremely important for beginners to educate themselves, but they usually have a hard time distinguishing between good information and bad information.

If they are lucky and make a successful investment, they get very optimistic. But if the market makes a downturn, they get very pessimistic. In short, their feelings towards cryptocurrencies fluctuate in rhythm with market conditions.

No one should invest more than they can afford to lose, and this is especially true for beginners. They have to be aware of the fact that there are risks associated with any investment, despite the tremendous upside offered by cryptocurrencies.

Don’t blindly follow others. Do your due diligence and your own research.

We believe that Kriptomat is ideal for beginners as it provides a user-friendly and safe platform for buying, selling, using and storing cryptocurrencies. It also provides educational content on everything crypto and strict security measures.

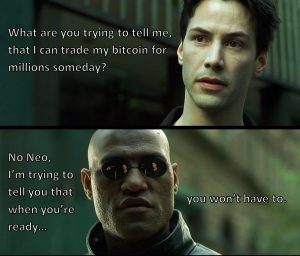

2) The “HODLers”

They have usually gathered a bit more experience but they don’t necessarily have the ability or the interest to trade cryptocurrencies on a regular basis. Instead, they (sometimes fiercely) believe in the long-term potential of cryptocurrencies.

They understand the volatility of the crypto market and are prepared to weather the storm, so to speak. Hodlers accept the inevitable downward and upward swings, and they react less emotionally to bear market and bull market scenarios.

Because of their long-term investment strategy, they are waiting for a good moment to cash out. The most extreme hodlers are even waiting for a time when they won’t have to cash out. What do I mean by this?

They’re anticipating a future in which bitcoin and others cryptocurrencies would be accepted as worldwide currencies; maybe even replace fiat money.

Will there be a paradigm shift in how society views the monetary system and Bitcoin?

The question with hodlers is how long they are willing to wait. One year, two years, or more?

Where does the term “HODL” originate from?

One of the most popular slang terms in the crypto community. It originated in a December 2013 post on the Bitcointalk online forum by an apparently drunk user who posted with a typo in the subject, “i am hodling.”

What he meant to say, of course, is that he is holding his bitcoin despite the downtrend after an all-time high price in November 2013.

HODL is sometimes also used as an abbreviation of the term Holding On for Dear Life.

3) The Traders

They often have the most experience, are well-read, and they closely follow every nuance of the market. Traders make detailed prediction models based on mathematical principles. They are prepared for the smallest of price changes, which is why they are not afraid of taking big risks.

Some investors are in it for the long term while others want to invest for the short-term and cash out as quickly as possible.

They usually focus more on market-related news like government regulations because it helps them see a larger picture. But even professional traders can’t predict the future. What they do have is the knowledge to maximize their chances of success in this market.

4) The Early Adopters

They bought bitcoin before it was cool, and they recognized its potential when others thought it was just a scam or a tool for illegal online transactions. The more official definition is that they start using a product or technology as soon as it becomes available. This can happen purely by luck, but they are generally interested in technology.

Early crypto adopters are often anonymous because it wouldn’t be the best idea to let everyone know that they sit on millions in bitcoin or that they have already cashed out millions. But early adopters are sometimes also big crypto influencers who have the ability to move prices merely by posting a tweet about a token or coin.

Conclusion

We didn’t cover all of all the different types of crypto investors. It is also possible for one person to be a part of multiple categories. For example, investors are often also “hodlers” and vice-versa.

If you are just starting with investing in cryptocurrencies, my suggestion would be to read about the technology as much as you can. Be honest with yourself and try to make an honest assessment of your strategies.

Which types of investors are most suitable for Kriptomat?

Beginners; because we offer a lot of educational content on our blog and we strongly believe that we have the most user-friendly exchange along with excellent customer support and security that includes KYC and AML procedures.

Hodlers; because they get a free digital wallet, with 98% of funds stored in a secure offline cold storage. They can also buy cryptocurrencies directly with euro and send the coins to their private wallet for long-term storage. In that sense, Kriptomat can be seen as a fiat gateway and personal crypto bank account.

Traders and early adopters are also welcome, but it is likely that they entered the world of cryptocurrencies before we even opened our doors to the public.

Disclaimer: Our blog posts do not represent an investment advice and nothing in them should be construed as investment advice. Blogs merely provide information and education for the interested public.

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android