Linear Calculator

Struggling to pick your first investment?

Create your Investment planLinear Price Overview

The current Linear price is 0.000024670 €. The price has changed by -19.62% in the past 24 hours on trading volume of 4674.65 €. The market rank of Linear is 5264 based on a market capitalization of 246594.50 €. Linear has a circulating supply of 9996646261.00 LINA. The highest recorded Linear price is 0.250240000 €. And the lowest recorded LINA price is 0.000017210 €.

How do Linear price movements correlate with market trends? Check our complete cryptocurrency exchange rate page for information at a glance.

Bitcoin Profit Calculator (DCA Investment Strategy)

Analysing Linear’s price history

Before buying any cryptocurrency, it’s worth doing your homework. That means analyzing the price history to look for recurring patterns and indicators that the price of your investment is more likely to rise than to fall.

Make sure your price prediction for Linear matches your long-term and short-term financial goals.

There are countless ways to analyse crypto price performance and make a buying decision. Two of the most commonly used are technical analysis and fundamental analysis.

Technical analysis is valuable in crypto investing even if you don’t have access to years of historical price data in the Linear chart. For example, with many cryptos, dramatic price drops and periods of high volatility have been followed by a sustained rise to new highs. There’s no guarantee that the pattern will be sustained in the future, but if it has been consistent in the past, it’s worth considering.

In fundamental analysis, you examine economic, financial, political, and social factors that influence prices. You collect information about interest rates, gross domestic product, manufacturing data, and unemployment rates to make informed predictions about stock prices.

News events are important too, especially economic indicators. Is the national bank raising interest rates? Are fiscal conservatives being elected? Have storms or droughts disrupted agriculture, tourism, and other industries?

Most investors find it best to apply both technical and fundamental analysis techniques when evaluating a purchase or sale.

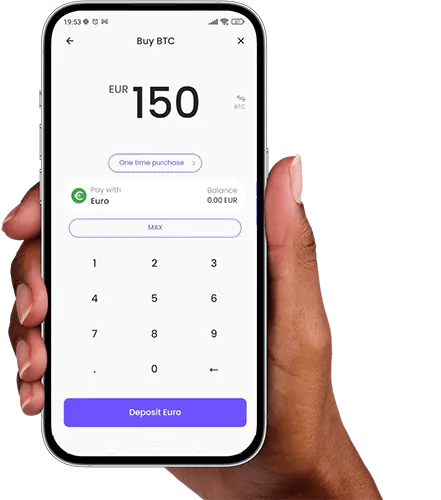

Buying Linear with Kriptomat Web3 Wallet

Discover where and how to buy Linear online. With Kriptomat, buying LINA and other cryptocurrencies is easy, quick, and secure.

Factors influencing the Price of Linear

Many factors affect the value of Linear.

The Linear exchange rate sometimes moves with changes in the wider economy. And sometimes crypto moves the opposite direction. For example, many cryptos have made impressive gains despite bank failures and economic uncertainty in international financial markets. This may indicate that investors have turned away from risky banks and turned to crypto, which has delivered historic long-term benefits.

Government regulations have a great impact on the price of Linear and other currencies. Tax policies, regulations regarding investments, mining restrictions, government plans for official digital currencies, and other developments can move the crypto market higher or lower.

Newsmakers increasingly influence crypto prices. When a billionaire entrepreneur tweets support for a particular coin or token, the price often goes up. More and more celebrities are promoting cryptos and NFTs to millions of followers on social media. The effects of these endorsements on crypto prices cannot be overstated. Watch for mentions of Linear in the news, monitor LINA on X. Visit the project’s online community at Discord or elsewhere. The better informed you are, the better the decisions you will be empowered to make.

Competition and ongoing technological changes make a difference too. Many Web3 tokens are related to established blockchains like Ethereum and Solana. Take Ethereum, for example. The Ethereum Foundation has been open about its plans for introducing new technology to the underlying blockchain. Will those innovations create an opportunity for Linear? Or will they close a technology gap, rendering Linear less valuable as an investment?

Live Linear value and market cap

The live Linear exchange rate varies from moment to moment as transactions take place on exchanges all over the world. Given the volatility of cryptocurrencies, prices can rise or fall significantly in a short period.

The market capitalisation of Linear is equal to the value of Linear multiplied by the number of Linear in circulation.

Where to buy Linear

So you’re ready to jump into the world of cryptocurrency and you want to know where to buy Linear (LINA)? Linear is available to buy, sell, and use with the Kriptomat Web3 Wallet – the simple and secure way to store your crypto.

What payment methods can I use to buy Linear

We’ve made it easy to top up your Web3 Wallet! You can fund your Web3 purchases via SEPA bank transfer, Visa, MasterCard, Apple and Google Pay, or Skrill to buy Linear (LINA).

What can you do with your Linear?

Buy Linear with euros

Access Linear tokens before they are listed on centralised exchanges. Get the best rates and purchase with your card or bank account, all on one platform.

Exchange Linear

Swap some or all of your Linear for any other crypto with ease. No crypto platform makes transactions as fast and convenient as Kriptomat.

Use Linear

Use the Linear you buy with the Kriptomat app to access Web3 dApps, DeFi applications, games, and NFT marketplaces.

Sell Linear for euros

Simplify your life with the Web3 wallet that lets you sell your Linear for euros in seconds. Easily withdraw to your bank account or bank card.

Earn Linear

With Linear, you can easily access DeFi with liquidity pools. Liquidity pools are funds that allow users to lend or borrow Linear at competitive interest rates.

Hold your Linear

Your Linear tokens will be securely stored in your Kriptomat Web3 wallet. You can save it for a rainy day or until you’re ready to cash in.

COMPARABLE MARKET CAP

COMPARABLE TRADE VOLUME

How much is 1 Linear worth?

(Euro)

(US Dollar)

(Bulgarian Lev)

(Czech Koruna)

(Hungarian Forint)

(Polish Zloty)

(Swedish Krona)

(Turkish Lira)

(Swiss Franc)

(Norwegian Krone)

(Romanian Leu)

(Danish Krone)

Linear Price FAQ

What factors influence the price of Linear?

Political events, the world economy, celebrity endorsements, and market news are among the countless factors that influence cryptocurrency prices. To see how Linear tracks the overall market, check out our comprehensive cryptocurrency price page.

What is the highest price of Linear in EUR?

Linear price history shows that Linear has recorded a peak value of 0.250240000 [object Object].

What is the current price of Linear in EUR?

Linear is available for immediate purchase at Kriptomat. The current price is 0.000024670 [object Object].

How can I buy Linear?

You can consult an expert to tell you how to buy Linear. However, it’s fast and easy to buy Linear with the Kriptomat app. Linear is available for immediate purchase at the current Linear price quote of 0.000024670 [object Object]. Current prices are always displayed in the Linear chart.

How much Linear should I buy?

If you’re purchasing tokens to use an app or play a game, explore the website and see how much you’ll need. If you’re acquiring Linear as an investment, take a look at your financial goals, your investment fund, and your portfolio. Smart investors build portfolios of 10 or more cryptocurrencies, balancing factors like anticipated growth rates, volatility, market niche, and more.

Is there an order minimum?

You can buy Linear for as little as €15 but bear in mind the blockchain fees that are charged for DEX tokens.

Is Linear easy to sell?

Though it can be difficult to bring yourself to part with any cryptocurrency, Kriptomat has made it as simple as possible to sell your LINA whenever you so choose – 24 hours a day, 7 days a week, 365 days a year.