Financial trading is a fantasy career for people around the world. Many of us dream of outsmarting the market and achieving financial independence.

Crypto lets anyone become a trader. There’s no need to register with a brokerage, pay expensive fees, qualify for trader status, or any of that with crypto trading. Just create an account at Kriptomat or another exchange and begin trading. It’s more accessible and more exciting than trading stock, gold, or soybean futures.

This guide will help you navigate the exciting yet risky world of trading cryptocurrency. Our goal is to give you a sensible perspective about crypto trading that most traders learn only after months or years of trial and error.

First things first: Trading is not a consistent or reliable way to make money. In fact, the rule of thumb is that most traders end up losing money — despite what trading platform advertisements might lead you to believe.

This guide does not provide any financial advice. Trading is entirely at your own risk. This guide is provided for educational purposes only. We hope it helps you manage the risks and make better choices if you do decide to trade cryptocurrency.

Three keys to crypto trading

Crypto trading means buying and selling digital assets (tokens, coins, NFTs) like those listed on our Cryptocurrency Prices page.

For the purposes of this discussion, a trader is not an investor. Investors set goals and build portfolios for long-term return. The trader is focused on profits right now. The goal is to get in and get out fast, pocketing the profits. That’s what day trading crypto is all about.

Most traders lose money. Some turn a profit.

There are three keys to trading:

- Fundamental analysis is based on the fundamentals of a company or project, including its product vision, its existing customer base, the quality of the team, partnerships, current revenue, and so on.

- Technical analysis focuses on the price chart using various indicators from the past to make predictions based on historical patterns. This is the main focus of most trading.

- The psychological game is about developing the right patience, discipline, and trading methods to reduce risk. This is the most important element of trading strategy.

The essential questions of trading reduce to this:

- What should I buy?

- How much should I buy?

- When should I buy?

- When should I sell?

Coins go up and down in value based on market perceptions about their value. Those perceptions are based on traders looking at the patterns of the price chart (technical analysis) and other market participants watching the news for project updates (fundamental analysis).

Choosing what to buy and when depends on a great deal of research and lucky timing based on market cycles.

How To Trade Cryptocurrency

Investing is both a skill and an art. Below, we outline some important considerations as you learn how to trade cryptocurrencies and how to day trade crypto.

The Boom/Bust Cycle

One of the most popular ideas in the crypto space is the “boom and bust” market cycle described by this cheat sheet:

The idea presented here is that markets repeat somewhat predictable trends:

- Bull trend: Prices go up and up. Hope turns to optimism, which becomes belief and then transforms into thrill and finally euphoria as prices reach astronomic highs.

- Bear trend: Prices begin to drop and investors are too complacent to sell, as they think the upward movement will continue. But then anxiety sets in as prices continue to decline, leading to denial, panic, anger and depression.

A full market cycle from boom to bust can take many months or even years.

Booms and Busts in Bitcoin Trading

Bitcoin is notoriously volatile, which means that it rapidly rises and falls in price. A recent Bitcoin boom came in January 2018 when Bitcoin reached a price of 15,000 euros.

The bottom of the bust was December 2018 when Bitcoin dropped to about 2,400 euros.

Then the cycle began again.

Your cryptocurrency trading platform should give you plenty of data for spotting market cycles – especially if you are trading Bitcoin. Visit our Bitcoin price page to see the current price chart for BTC.

This pattern is essentially a fractal, which means it repeats across time-frames. Tiny boom/bust cycles within medium-size boom/bust cycles within big boom/bust cycles. They don’t always show the exact same pattern, but the main shape of the cycle is apparent when you zoom out.

This fractal dynamic allows the discerning trader to spot cycles at different time frames (hourly, daily, weekly, monthly) and then take advantage at the right moment by timing entry and exit positions accordingly.

The best way to trade crypto is to do lots of study and preparation. The danger is getting drawn into the day-to-day, hour-to-hour, even minute-to-minute volatility of the markets, leading newbie traders to over-trade based on the heat of the moment.

Trading Cryptocurrency 101: Avoid Emotional Trading

Learning technical and fundamental analysis certainly takes some time. But it’s not the most difficult part of trading. The toughest job that traders have is managing their own emotions and being disciplined enough to follow their strategy instead of emotion-based impulses.

All traders struggle with emotional trading. The temptation to trade is almost overwhelming. We see so much profit potential. Coins jumping 5% here, 8% there, then dropping back down again. If only we could capture those price jumps! Can you day trade crypto to capitalize on the market’s volatility?

Yes – if you’re disciplined about it. Analyzing trades requires a ton of discipline. Most people see some hype about a particular stock or a crypto coin, they see the price is already starting to shoot up, and they don’t want to get left behind, so they buy too much at once. FOMO – the fear of missing out – plays a role. Then the market cycle reverses and prices start to tumble. The trader sweats with anxiety until their hopeful position recovers and enters profit again, or they sell for a loss.

This is emotion-based trading. It is common. It is not a good strategy.

Effective traders know they must overcome the natural emotions of hope, greed, panic, guilt and excitement. Traders are not meant to be gamblers. They are meant to be strategic, objective, rational planners.

Pump and Dump Schemes

Unfortunately, unscrupulous individuals or groups attempt to take advantage of the excitement and greed of trading by rallying buyers to invest in a particular crypto which does not have very much trading volume.

This causes a surge in the token’s price, at which point the scammers sell their own tokens — raking in lots of profit — while other investors are left holding coins they bought at an inflated price. The price tumbles back down to its natural market position.

This is known as a “pump and dump.”

To avoid these schemes, consider trading volume when you select coins or tokens to trade. And avoid the temptation of the fear of missing out. FOMO can lead you into a lot of bad decisions if you’re not careful. When you’re trading cryptocurrency for profit, it’s important to keep a level head and evaluate opportunities thoroughly.

How to trade cryptocurrencies using technical analysis

Here’s a simple way to get started with technical analysis. You can look for market correlations by comparing price charts for different coins.

For example, check to see if the coin you want to trade is positively or negatively correlated with Bitcoin. That is, determine whether its price tends to move in the same direction as Bitcoin’s at different trading periods.

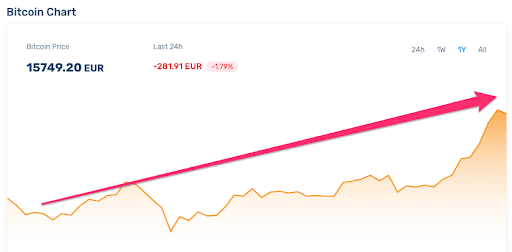

Here’s a price chart for bitcoin (BTC) showing one year of data:

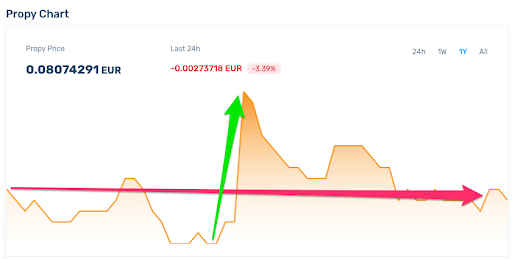

Here’s the price chart for Propy (PRO) for the same period:

As you can see, the price of Propy has been volatile, but at the time of writing it was just about the same as it was a full year earlier. From that perspective, holding Bitcoin during that year would have been much more profitable. (Unless you bought at the low point and benefited from a sudden spike, as shown by the green arrow.)

This type of analysis may help you decide whether to keep more of your portfolio in BTC or branch out into coins that usually gain or lose value compared to Bitcoin.

Having a diversified portfolio is a sensible way to minimize losses and take advantage of market gains.

Your next step, of course, is to establish an account at the best crypto trading platform.

Good luck!

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android