Many people are interested in cryptocurrencies, and a growing number are investing. But even among those who regularly trade cryptos, there are few who actually understand the underlying technology.

This arises from the fact that cryptocurrencies are, at present, largely used as speculative tool. A lot of people are chasing profits and don’t care about anything else. Only minimal technical knowledge is required to get involved with trading, but we believe it is useful to know the basics. Education will eliminate uncertainty and doubt, which are still a large part of the broader public view on Bitcoin and other cryptocurrencies.

Mining is a case in point. Let’s dive in.

What Is Crypto Mining?

Mining is essentially a distributed consensus system. It’s a mechanism through which many people around the world are involved in maintaining crypto networks. “Mining” is a term used to describe the process of validating transactions that are waiting to be added to the blockchain database. Mining is essential on Proof of Work blockchains like Bitcoin’s. Newer blockchains tend to use Proof of Stake and other consensus mechanisms, and they do not need or allow mining.

On Proof of Work blockchains, mining establishes the chronological order of transactions, which is essential in ensuring that previous entries to the crypto “open ledger” can’t be changed. If a transaction is to be successfully confirmed and included, it has to be packaged in a block that must comply with strict encryption rules. Those are verified and validated by the miners on the network and there is no involvement of any government authorities. This protects the neutrality of the Bitcoin network.

We can make a quick comparison with using credit cards in the traditional electronic money system. Every payment must be verified and recorded by the credit card company (for example, MasterCard or Visa). We could say that the entire cash flow of the contemporary banking system is recorded in centralized systems, and they are very susceptible to manipulation.

Cryptos like Bitcoin don’t have centralized organizations that confirm transactions. With Bitcoin, that work is done by miners. They create new Bitcoins in the process.

The process is called mining due to its many parallels with gold mining. Both scenarios involve investing a large amount of work and energy to produce a highly valuable asset.

What is crypto mining? It’s a way of rewarding those who validate blocks of transactions so they can be added to the blockchain.

The basics of mining cryptocurrency

How does crypto mining work? Let’s start our explanation with an analogy.

You are probably familiar with the basics of gold mining. We have to put in a certain amount of work to retrieve the raw material that has value in the eyes of the people. Bitcoin is not much different in that regard, except that it is an entirely digital resource, so the mining process takes place in the virtual world.

Obtaining gold is simple, but the process can be volatile and unpredictable. Mining cryptocurrency is much the same.

There is an economic incentive for gold mining when the costs associated with the mining of one ounce of gold (labor, paychecks, equipment) are less than the value of one ounce of gold.

Bitcoin is similar, but there are slight differences. The miners are discovering new Bitcoins at pre-determined, rising levels of difficulty and increased energy consumption.

There is an economic incentive to mine Bitcoin when costs associated with the mining of Bitcoin (electricity, computing power) are lower than the value of the mining rewards.

on your crypto.

What kind of rewards are we talking about?

Rewards

The most successful miners are rewarded with new Bitcoins if they successfully add a new block to the blockchain.

Nowadays the prize is never received by one single person because no one in the world has enough computing power at their disposal to solve the complex mathematical operations needed for successfully validating a block. Miners therefore team up, creating so-called “mining pools” so they can join forces. The award is then distributed in proportion to the work each member of the pool did. Those with more computing power receive a higher prize.

The reward is halved every 210,000 blocks. At the time of writing this article, the Bitcoin block height is 567,000. This means that the entire Bitcoin blockchain contains 567,000 blocks. Each block is linked to the previous one in the chain all the way back to the original Genesis block.

Miners were initially rewarded with 50 Bitcoins, and in 2012 the reward was halved to 25 Bitcoins. Halving occurs once every four years. You can monitor the countdown here. Halving events coincide with the Summer Olympic Games.

Security and difficulty

The more miners there are, the more secure the network is. A large pool of miners means that it is virtually impossible for anyone to manipulate the network and its assets.

The downside is that an increase in the number of miners also increases mining difficulty (and decreases profitability). Roughly speaking, the difficulty is adjusted according to how much computing power is distributed throughout mining networks. This adjustment ensures that a block is always added to the blockchain roughly every 10 minutes (and not sooner or later due to a varying number of miners).

A higher difficulty, in theory, means a lower profit for the miners. This is because the reward is distributed to a larger number of miners, so each one of them receives a smaller share. That’s not a big issue if the Bitcoin price is high or if miners have access to cheap or free electricity.

It can happen that the mining reward doesn’t cover the costs of mining. In that case, many people continue with their mining operations, mostly because of their belief that Bitcoin will be worth more in the future.

What is cryptocurrency mining? And what is Bitcoin mining in particular? Mining is the process of verifying transactions and creating new coins.

How To Mine Cryptocurrencies

What is mining cryptocurrency? Now you know. You may even have itchy fingers to try it out yourself. So let’s take a look at the hardware equipment and the necessary procedures to establish a home mining operation. Get your pickaxe ready!

Hardware

The first step to start mining Bitcoin is to invest in appropriate computer hardware. A faster, more powerful computer increases your chances of success.

In principle, anyone can mine cryptocurrencies. You just have to run mining software on your computer. But you’re unlikely to have any worthwhile profits without some research.

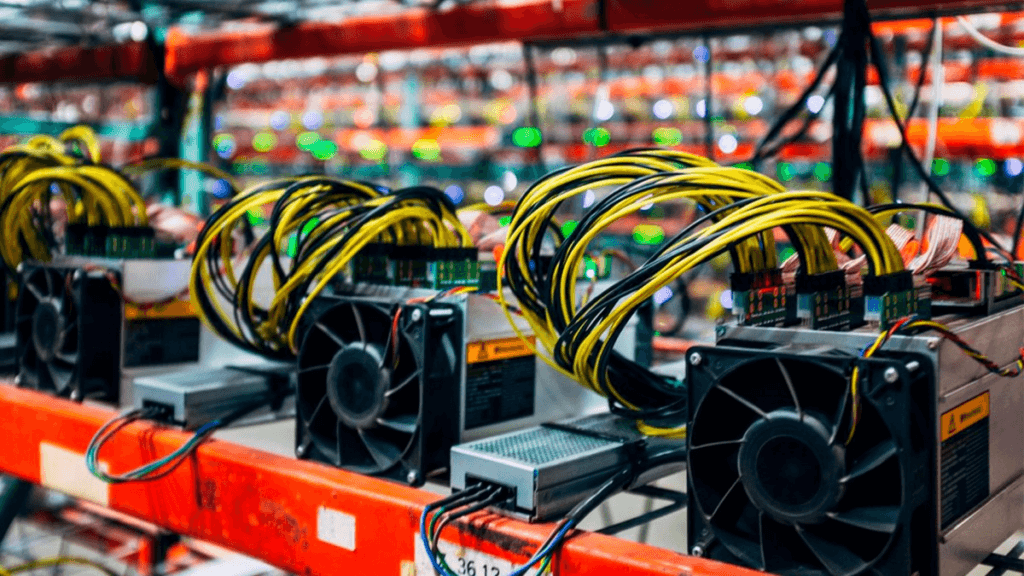

In the first few years of Bitcoin’s existence, it was enough to use ordinary home computers and consumer-grade graphics processing cards, but in recent years this has become largely ineffective. A large contributing factor was the rise of application-specific integrated circuits designed for mining. ASICS perform only the specific types of computational operations that are required for crypto mining. These loud, hot devices that are not suitable for domestic environments. Is crypto mining profitable? It can be. But if you want to make your fortune with Bitcoin mining, you should be prepared to shell out lots of money for custom hardware.

Ethereum gained a lot of popularity in 2016 and 2017 partly because it enabled large profits of coins using home computers, combined with a growing market, as well as large profits.

Mining Pools

Miners soon realized that they could increase their profits by combining more GPU units. As a result, entire mining farms were built in regions where there is cheap access to electricity and computer equipment. These farms made many millionaires. Some mining companies even outsourced their computing power by renting it to consumers.

In light of the increasing popularity of Bitcoin mining, some people also started to merge into so-called mining pools, which increase the chances of receiving the reward.

How To Start

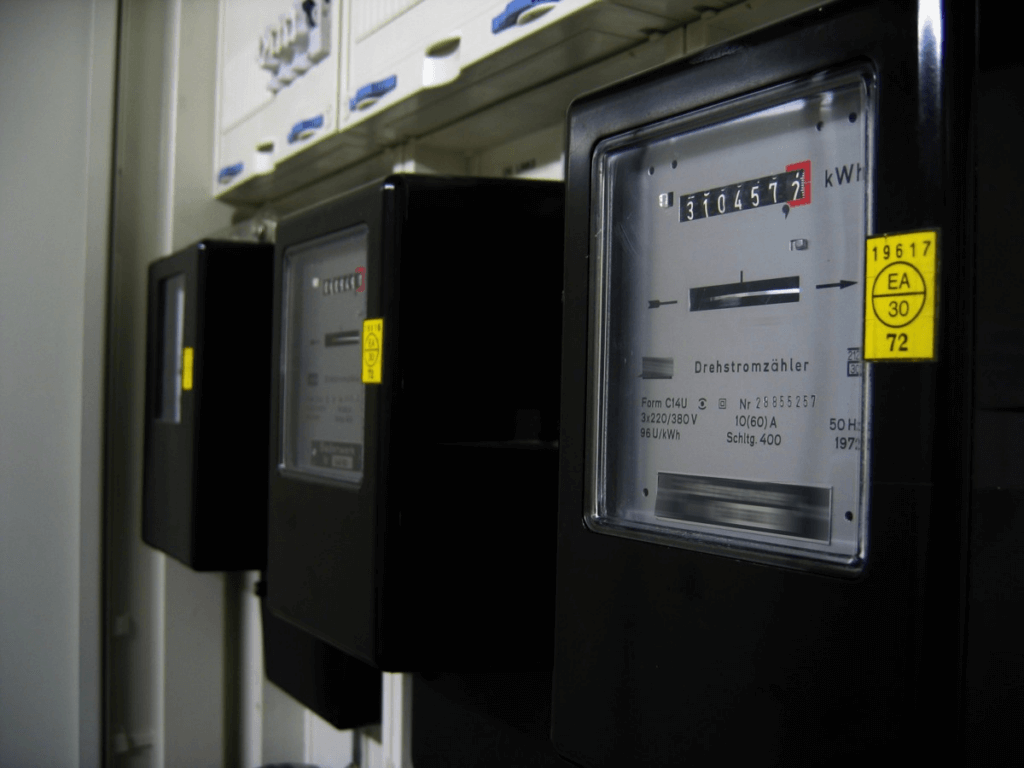

Crypto mining demands equipment that uses as little electricity as possible. We are always searching for the best combination of price and performance.

If you decide to start mining cryptocurrencies, you must realize that you will probably have a hard time due to the price of electricity. We call this solo mining, but it is recommended that you join a mining pool or a community that uses their combined computing power in order to mine cryptocurrencies.

Where does the term “pool” come from? Let me explain with an example. Think of computing power as water, and the entire Bitcoin network as one large body of the sea. People with the largest amount of water will have the greatest chance of receiving the reward. Most people only have a small bucket of water. As a result, they group together and pour their water into a pool. If their pool receives a prize, then it will be distributed proportionally according to the amount of water poured by each individual.

Beginners are therefore advised to join a mining pool. But be careful and choose only well-known mining pools.

You will need specialized software without which it will not work, even if you have the best hardware for mining cryptocurrencies. A good deal of technical know-how is required to set up the software, so this process is intended for those with a bit more experience.

How To Receive Rewards

After you set up your mining hardware and software, you can immediately start mining! But you may be wondering where you will receive your potential earnings.

Payouts are mostly carried out with Bitcoin because it is by far the most popular cryptocurrency in the mining community.

You probably already know that Bitcoin cannot be saved to your bank account, so you will need a crypto wallet. Your Kriptomat wallet is an excellent choice.

The mining software will transfer any rewards you earn to the crypto wallet address you specify.

Energy Consumption

Crypto mining has a price: power consumption. The mining equipment is constantly working at maximum load, and huge amounts of energy are wasted in the form of extra heat. As a result, many major mining operations are housed in northern countries, where it is easier to reduce the cost of electricity associated with cooling.

It is difficult to accurately assess the impact that the Bitcoin mining has on the environment. But it is clear that crypto mining, and Bitcoin mining in particular, have contributed more heat to the warming world than many countries. Depending on how the electricity is generated, mining is contributing to greenhouse gases too.

What does mining crypto mean?

We live in interesting times. People are investing a lot of time, effort, and energy into mining virtual assets that are recorded with digital ones and zeros. It seems strange, but it’s just a natural social and technological development. What was strange yesterday will be normal tomorrow.

Civilization is based on the exchange of goods for currency. Who says that this system doesn’t have room for entirely digital currency? As it is, the entire financial system is migrating into a digital domain anyway.

The world is increasingly digital, and crypto has a very interesting role to play. Miners are a critical part of the system.

NOTE

This text is informative in nature and should not be considered an investment recommendation. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose.

IOS

IOS Android

Android